Financial performance

Our funding model is premised on the organisation being commercially viable and financially independent. This model ensures that our financial administration is sound, our cash flow is properly managed, and our internal controls, systems and processes are intact. The organisation has leveraged the benefits of this model to remain solvent and cover operational and capital expenses, including our technology requirements.

We produced a fair set of financial results given South Africa’s financial constraints, but look forward to audit efficiencies resulting in less audit work being assigned to private audit firms.

Audit income

Our actual audit income for the year ended 31 March 2023 was R4 583 million (2021-22: R4 395 million), representing a year-on-year increase of 4%. We managed to contain the increase in audit fees using efficiencies derived from pooling staff between national and provincial business units and continuous improvement in productivity and recoverable rates (own hours’ revenue).

The pooling resources initiative is being institutionalised, realising R221 million (2021-22: R120 million) in audit income. This approach will allow us to increase revenue generation and optimise operating costs.

Towards the end of the 2022 financial year, we introduced the recoverable Ahluma centre. Through Ahluma, we could retain audit seniors or audit clerks and create opportunities for these young professionals to work with multiple business units and gain a diverse skillset. They, in turn, could contribute by executing our audits instead of private audit firms. In its three months of operation, Ahluma produced revenue that equates to a R20 million saving on outsourced private audit firms.

Our overhead expenses of R1 405 million are 19% above the previous year’s expenditure of R1 180 million. The increase was mainly driven by inflation, personnel costs for capacitating some business units, course fees and study assistance, as well as key initiatives to support our #cultureshift2030 strategy. We are committed to keeping overhead expenses within budget by enforcing stringent spending controls and implementing cost-cutting measures to mitigate any potential income loss in the future.

Working capital

In this financial year, we formed a credit watchlist committee to improve existing collection initiatives. The committee’s primary responsibilities include managing the watch list (a list of all debtors with accounts that are 90 days past due), suggesting creative collection techniques including ringfencing and overseeing the litigation process.

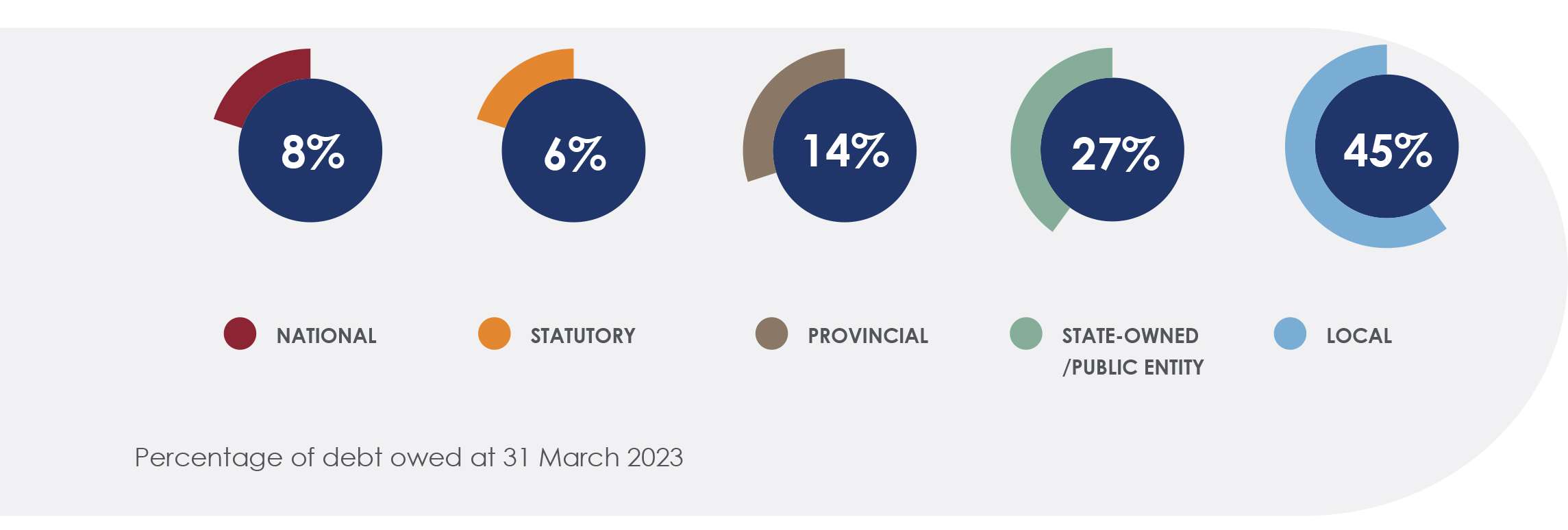

The AGSA debt book closed at R1 080 million, up from R1 060 million in the same period last year, and represents 24% of total revenue (2020-21: 24%).

Of this debt, R371 million or 34% is owed for 120 days or more, mainly by auditees in financial distress.

The improvement in local government debt is due to our intensive collection activities, which entailed settling outstanding debt through ringfencing and our tighter collection target.

Debt collection

We anticipate that the quality of our debt book will improve as we continue to enforce collections in line with our accounts receivable policy and the PAA. We made notable strides in collecting debt by implementing the following strategies:

Debt collection strategies

- Enhancing our collection targets

- Continuing engagements with the National Treasury, which resulted in R76 million being paid to

resolve the two-year funding shortage for 1% debtors. This was in addition to the R72 million received

during the course of the financial year. - With effect from 1 April 2023, we will receive the full 1% allocation from the National Revenue Fund.

We estimate the amount we receive will increase from an annual average of R72 million to

R123 million.

We continued to use ringfencing and litigation strategies to boost collections. We collected R60 million (2021-22: R53 million) through ringfencing agreements (R49 million) and short-term payment plans (R11 million). This project is still regarded as beneficial since it helps certain debtors catch up on previous debt while paying current debt.

Summary of the debt collected through ringfencing agreements

| Financial year | Ringfencing agreements | Ringfenced amount | Amount paid |

|---|---|---|---|

| 2022-23 | 11 | R128 million | R60 million |

| 2021-22 | 17 | R107 million | R53 million |

The effort to enforce debt collection through litigation collected R199 million, compared to R156 million in the same period last year.

Summary of the debt collected through litigation

| Financial year | Litigation cases | Litigated amount | Amount paid |

|---|---|---|---|

| 2022-23 | 55 | R246 million | R199 million |

| 2021-22 | 30 | R231 million | R156 million |

The payment of post-retirement medical aid liability

We partially paid the post-retirement medical aid liability by offering a buyout to 337 members (91%). The buyout, implemented in the third quarter of the financial year, contained a 20% bonus for accepting the offer. Of those approached, 258 members accepted the offer, which cost R42 million, including a R7 million bonus. Most of these were paid out in the 2022-23 financial year.

The post-retirement medical aid obligation of R49 million has reduced by R36 million (or 74%) to R13 million as of 31 March 2023.

Safety margin and net surplus

Working capital management is crucial to ensure that we have enough cash to pay our expenditure and debts when they fall due. Debt collections and paying our suppliers on time is also very important.

Our bank balance closed at R707 million (2021-22: R770 million), which translates into a margin of safety of 1,6 months compared to a target of 2 to 3 months. The buy-out process of the post retirement medical aid liability and settling more creditors to reduce our liabilities has contributed to the low margin of safety.

Our net surplus increased from R40 million in the previous financial year to R263 million. This increase was as a result of cost optimisation strategies as mentioned in this report. The increase in our net surplus will assist to preserve our liquidity and financial sustainability as we continue to navigate the difficult economic and fiscal challenges.

Conclusion

Our financial viability and independence will continue to be solid for the foreseeable future and will be able to respond well to unforeseen circumstances. Going forward, we will direct our efforts towards attaining our #cultureshift2030 strategic goals. This will necessitate improving our financial management system, automation and integrated business processes.

Human capital performance

The AGSA invests a great deal of effort into acquiring and developing the type, quantity, quality and configuration of resources and organisational capabilities necessary to drive our public sector culture shift and high-impact outcomes.

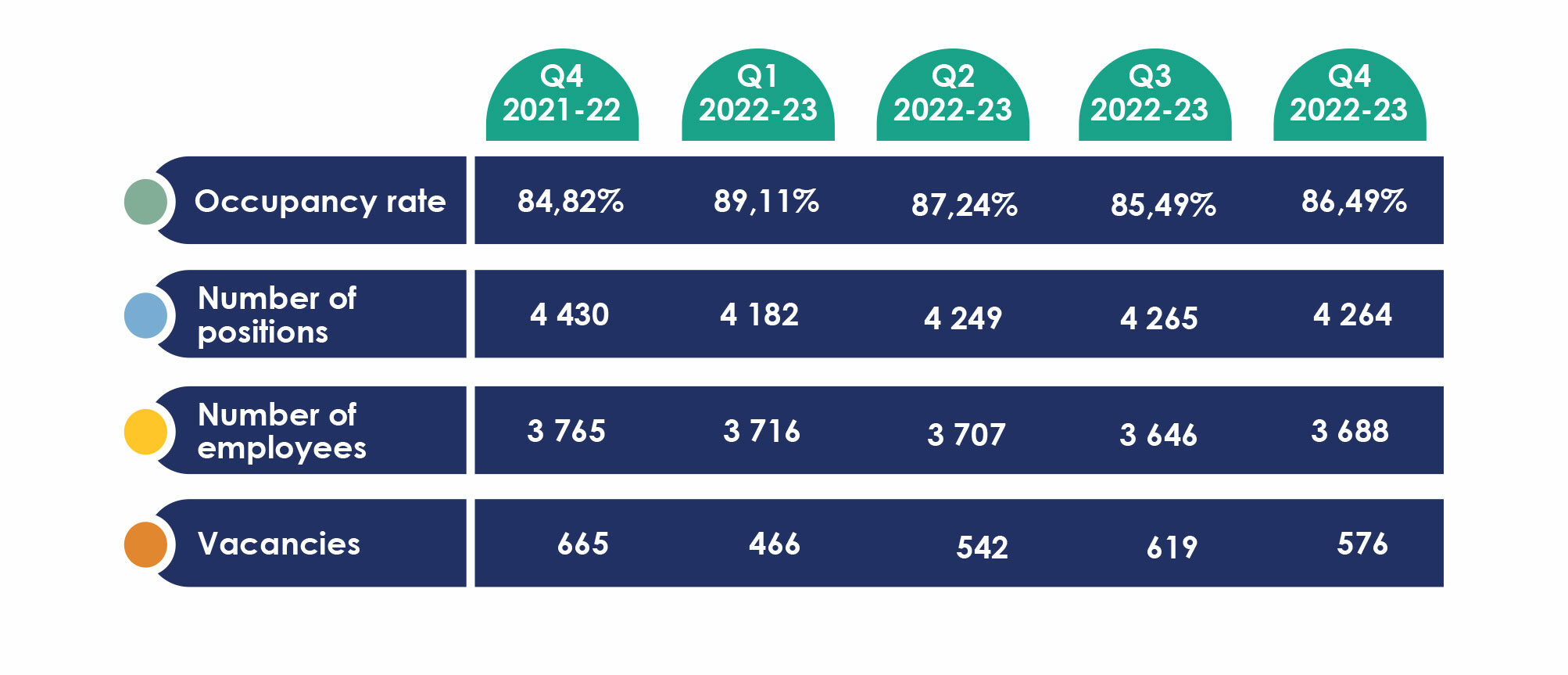

AGSA workforce profile snapshot 2022-23

The staff voluntary turnover rate (excluding trainees and staff on short term contracts) was 9,98% for 2022-23. Although this reflects an increase of 4,11% from last year, it is in line with the industry benchmark of <10%.

Our staff remains our most valuable asset. Creating an environment to promote engagement and contentment will allow our employees to flourish and achieve their full potential, for their own and the organisation’s benefit. We believe that promoting good health and wellbeing can be a core enabler of employee engagement and organisational performance. Wellbeing relates to all aspects of work life including physical, emotional, financial, social, career, community and purpose elements.

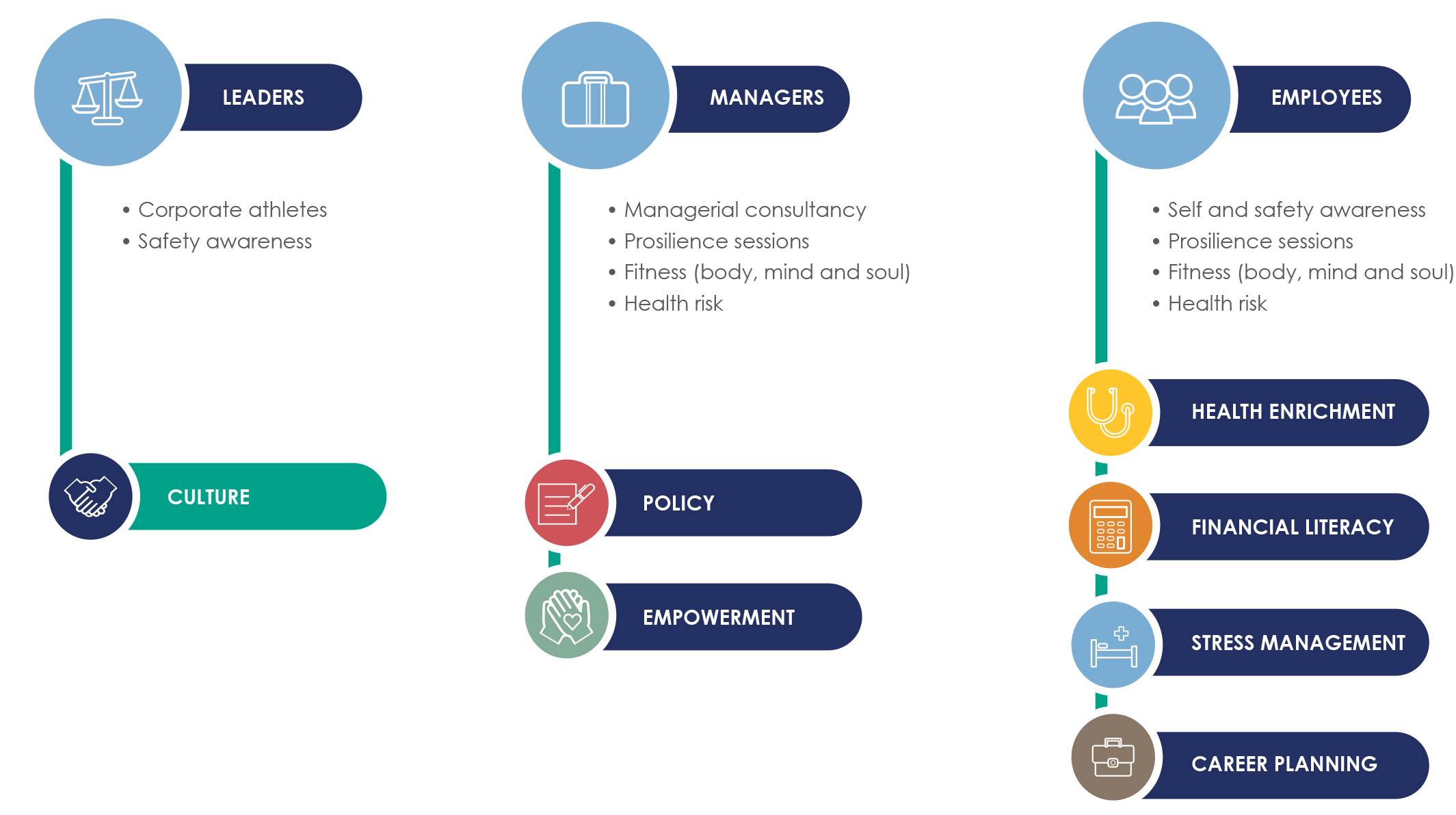

Promoting staff wellbeing

Informed by our business insight, we developed holistic wellbeing initiatives and interventions that could provide our staff with the tools to help them thrive, be resilient, safe and productive, and to improve their overall health and wellbeing.

We are on a continuous drive to foster an environment that enables employees to meaningfully contribute towards achieving our strategic aspirations. This means providing support for issues such as mental health, relationship problems, personal development, organisational and management issues, all of which continue to be prevalent, not only within the organisation but in similar industries and globally.Understanding that the fear of not delivering and a rapid change in the new ways of working lead to more work-related anxiety, for both employees and leaders, we offered psychological support to empower them with better understanding of their locus of control.

This intervention concentrates on the four elements of hope, efficacy, resilience, and optimism, all of which share an appreciation and positive evaluation of psychosocial events. The plan is to implement this initiative across the organisation by the 2023-24 financial year.

The corporate athletes programme is aimed at addressing executives’ wellbeing concerns in a personalised way. This initiative was implemented to assist executives with their mental health and holistic wellbeing, and to embed the culture of wellbeing and value of care within our organisation.

The corporate athletes programme is aimed at addressing executives’ wellbeing concerns in a personalised way. This initiative was implemented to assist executives with their mental health and holistic wellbeing, and to embed the culture of wellbeing and value of care within our organisation.

Recruitment (talent acquisition)

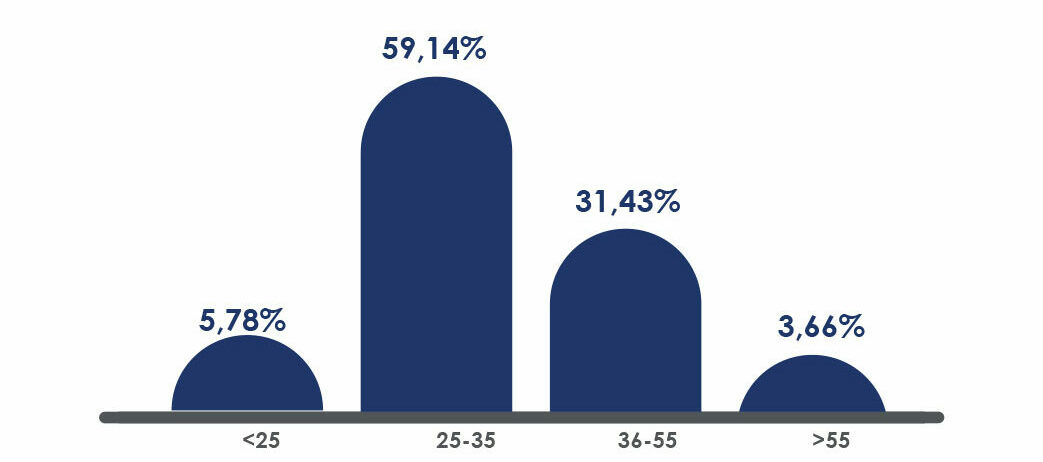

The need to fill critical positions that impact the delivery of our mandate and strategic goal saw an increase in both internal and external appointments. Internal appointments of 351, reflect an increase of 75,5% from 2021-22 recruitment and 163 external appointments, excluding trainee auditors, were a 136% increase on last year.

The demand for graduates with Certificate in the Theory of Accounting (CTA) continues to increase and, post-pandemic, competition from international firms recruiting in the South African CTA market has grown bigger.

This necessitates more agility and innovation in our recruitment practices. We appointed 182 trainees with CTA: 148 trainees commenced their training in the fourth quarter of the 2022-23 financial year, while 34 are scheduled to begin in the first quarter of 2023-24. This year’s intake reflected a decline of 19% (43 trainees) compared to the previous intake of 225 trainees in 2021-22.

In response, we have introduced new attraction initiatives, which will form part of our broader talent acquisition plan going forward. We will also, for the first time in 2023, introduce a midyear intake of CTA graduates to accommodate for the initial shortfall in resourcing our audit business units.

Our attraction initiatives include:

- creating awareness of the AGSA value propositions such as competitive salaries and benefits, professional development, promoting a positive work-life balance

- providing insight to our values to showcase a diverse and inclusive workplace culture

- following innovative recruitment strategies, such as our talent-centric social media messaging campaigns, industry-specific events, webinars, publications and targeted outreach to diverse online communities

- partnering with universities and industry-specific associations to attract the best-fit talent with diverse skills such as auditing, data analysts, forensic accountants, and information systems auditors

- organising campus recruitment drives, on-campus events, and industry-specific competitions

- showcasing the diversity within the workplace and its commitment to retention, upskilling and career development

- marketing the AGSA as the largest CA training programme in the world and acknowledging the responsibility we have to continue building the best CA(SA) talent in South Africa

To enhance innovation and diversify our workforce we appointed talented individuals to strategic leadership roles in the field of digital skills. These digital and analytical skills have enabled us to leverage tools and techniques to create a data-driven enterprise. The hidden value in data science and predictive analytics can streamline and optimise the way we work.

Employer of choice recognition

We were recognised as the employer of choice in the public sector for the third consecutive year in 2022. Being voted the top employer in the public sector by graduates showcases the AGSA as an organisation that provides an uplifting working environment for graduates entering the workforce.

Talent management and rewards

The culture shift strategy calls for diversified skills and capabilities. We identified the need to create career journeys for professionals, and redesigned the performance management framework to focus on career advancement and progression. We benchmarked salaries against both the national market and financial services and discussed the outcomes with remco. The work will be completed in phases in the 2023-24 financial year.

Comprehensive consultations about changes in the pay structure, possible policy/procedural changes and voluntary benefit structure (group risk benefits) will be held and alignment with other people management processes ensured.

Our organisational culture change journey

Our collective commitment is to build an enabling and supportive environment that sets the platform for the #cultureshift2030 strategy. One of the key focus areas during this performance year was on the development of a bespoke cultural change programme using a trust model.

Cultural change programme

We successfully developed the overall content and related toolkits for all our culture initiatives that have been rolled out on various platforms.

A big part of the programme was the introduction of the change leadership framework that encourages our leaders to build resilience and capability at the individual, team and organisational levels to anticipate, prepare for and adaptively respond to constant change.

Learning and development

Employee training

Our training hours reduced this year, with employees spending on average nine hours less on training. We halted technical training for six months while the updated audit methodology for the ISQM 1 was being developed. We expect training hours to increase significantly with the updated methodology and the #cultureshift2030 strategy.

With a notable increase in the resignations of our state-owned enterprise auditors, our need for basic training in this area grew exponentially. In total, 549 employees attended 6 061 hours of state-owned enterprise training. Our plan over the next financial year is to develop initiatives that will ensure the sustainability of this capability.

Leader training

The executive and leadership development programmes (EDP and LDP) saw a steady stream of graduates with 27 executives graduating from the EDP and 114 leaders completing the LDP.

The first 10 students in the LDP train-the-trainer model have completed their training and will focus on facilitating the manager development programme inhouse. This will save money on external trainers, upskill our employees and lead to consistency in training.

Young professional development

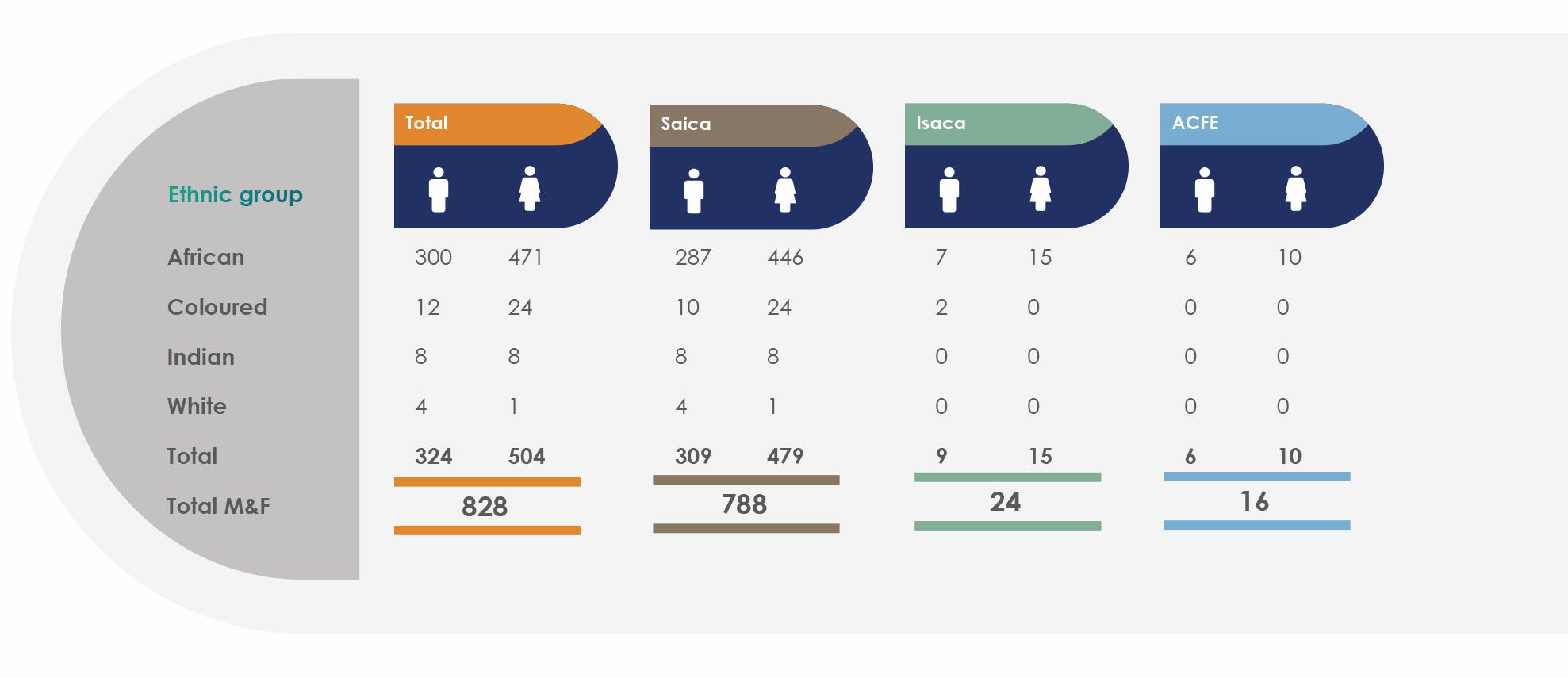

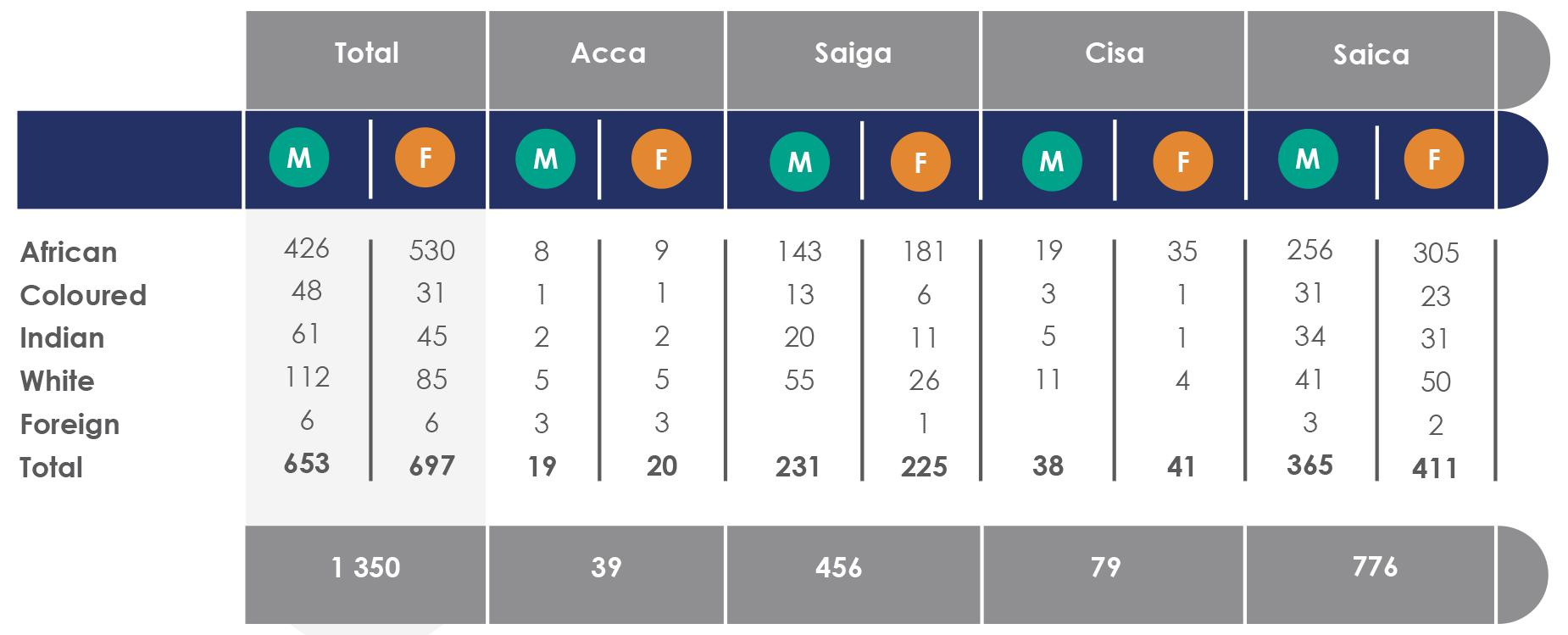

The management of our trainee auditors’ path through their training is done against a well-considered tactical plan, which has been in place since 2021. Our support is for the chartered accounting, information system auditing and forensic auditing disciplines. The number of our young professionals decreased from 1 151 in the prior year as a decision was made to focus recruitment on trainee auditors with a CTA in 2023, which limited the annual intake.

We countered the lack of entrants with CTA by retaining a large number of those who had already completed their learnership. The numbers of auditors on the Certified Information Systems Auditor (Cisa) learnership decreased from 36 in 2021-22 due to a deliberate decision to pause while we take time to define our information systems audit strategy.

Young professionals in training at the AGSA

In the 2022 academic year, exco approved a special CTA study support programme for trainee auditors. We invested R4,9 million (excluding lost revenue) in the programme which resulted in a humble 30% success rate for our AGSA candidates. We are now working on a more appropriate offering for the existing trainee auditors who are studying towards CTA. At Unisa, from which we source candidates with CTA, only 53 candidates passed nationwide (15% were from the AGSA). We are reconsidering the continued use of this programme.

The Assessment of Professional Competence (APC) is the final test of competence in the chartered accountant journey and the penultimate exam. A total of 239 of our candidates succeeded, the third largest contributor to successful candidates in the country, i.e. 9% of successful CTA candidates come from our training programme. This proportion has increased steadily in the last four years.

*These candidates were in the AGSA’s employ as at 31 March 2023

Just at the end of the financial year, 31 March 2023, Saica released the Initial Test of Competence (ITC) results. Our candidates achieved a 53% pass rate (those writing for the first time achieved an 85% pass rate).

Currently, we employ a sizeable cohort of audit professionals:

Bursary scheme

The AGSA external bursary scheme provides financial assistance to potential AGSA employees who are keen to pursue a career in the accounting and auditing profession. The scheme enables us to have access to skilled professionals for the execution of our mandate and strategy, as well as to support the transformation objectives of the chartered accountancy profession.

During the 2022-23 financial year we distributed R5,4 million to 36 academically gifted young people and provided opportunities to persons with disabilities, candidates selected from our schools support programme, as well as AGSA employee family members.

The Thuthuka development fund administered by Saica provides all-round, holistic support to talented African and coloured students who want to become chartered accountants. The AGSA-Thuthuka partnership continues to highlight the importance of the AGSA as a formidable training institution in the public sector.

We contributed R11 497 125 to Thuthuka for the 2023 academic year. In return, 32 Thuthuka candidates began their articles with the AGSA in 2023.

Transformation

Our transformation journey continues to evolve and, in support of our strategy, goes beyond compliance; we aim to contribute meaningfully towards building an inclusive society that is characterised by equitable opportunities for employment that embrace a diversity of skills, procurement processes that drive inclusive growth, strong partnerships with non-governmental organisations and community uplift programmes that reach the most vulnerable groups in society.

We have maintained a level 1 B-BBEE recognition status for the fifth year. Our success is attributed to ongoing commitment from our staff and leadership on this transformation agenda.

We continue to strengthen messages of diversity and inclusion through our employment equity forums. Webinars have become an important way of educating and empowering staff on matters such as prevention and elimination of harassment in the workplace, equity deviations and other difficult topics continue to be an area of focus.

In addition to building skills in the auditing and accounting professions, our trainee auditor scheme also aims to contribute positively to youth employment through our learnership programmes. We are accessing opportunities to partner with non-governmental organisations that support youth employment initiatives. Possible risks associated with such partnerships are actively managed.

Our contribution to socioeconomic development focuses on investing in educational programmes, social relevance and strategic relationships. Our school programme as well as our corporate social responsibility initiatives remained constant. Our donations to people affected by floods in the KwaZulu-Natal and Eastern Cape partnership with the Red Cross made a real difference.

We are investing in strategic relationships on transformation matters with professional bodies, audit firms and some of our auditees.

Achieving targets for employing people with disabilities remains a challenge. The matter is receiving our highest attention. Similarly, cost containment measures impact the availability of funds for training.

Enterprise and supplier development (ESD)

The objective of our ESD programme is to accelerate growth and the sustainability of black owned enterprises in the auditing and accounting industry by providing financial and business support to help qualifying companies overcome obstacles and increase their market competitiveness, and ultimately to create jobs and become sustainable.

The ESD programme runs over a five-year cycle. In March every year, ESD beneficiaries are assessed to determine which will proceed with the programme. In 2022-23, 24 firms began the programme.

Pamag Inc. a black women-owned firm graduated to supplier development. The assessment for firms ready to graduate out of the programme is still in progress and will be finalised before the new tender cycle.

The overall budget for the ESD programme for 2022-23 was R3 million, and was used in full. The main support provided to the firms aimed to align their operational infrastructure with our specifications.

| Firm Name | Amount Spent | Reason for Support Provided | |

|---|---|---|---|

| Masa Inc | R425 000 |

|

|

| NUE Inc | R875 000 |

|

|

| Thamani Inc | R600 000 |

|

|

| Pamag | R435 000 |

|

|

| Mpako Harvest | R400 000 |

|

|

| Maine Inc | R265 000 |

|

Employee relations

CCMA disputes by outcomes

- 7 disputes, which is fewer than last year

- 3 are still ongoing

- 3 were in favour of the AGSA

- 1 was withdrawn by the employee

Our employee relations root cause analysis helps support business with proactive interventions for identified misconduct to avoid recurrences. Such interventions further drive an internal culture of transparency, care, trust, and accountability.

Working hard to address the identified triggers and prevent disputes, bolsters employee morale and ensures legal compliance.

Technology

Repositioned ICT function

Our ICT function underwent a series of changes in 2022-23 to form a sustainable technological foundation for our #cultureshift2030 strategy. The ICT function now forms part of the Digital and Technology Office (DTO) portfolio and delivers based on the approved novel DTO strategy, which aligns our technology investments with our strategic priorities.

It is built on four key pillars for supporting and enabling the organisation:

– enabling data-driven decisions

– strengthening our core operations

– improving our customer and user experience

– automating our business to bring about efficiencies

The strategy reinforces our ability to adapt and thrive in the ever-evolving digital landscape, emphasises innovation, strengthens cybersecurity and promotes agile IT governance.

A new strategic enterprise architecture and a revised ICT operating model and structure drove the formation of a future-fit unit with the right mix of IT skills. We are delighted to reflect that by March 2023, the ICT unit had filled 98% of all vacancies and is fully responsible for our IT infrastructure, its operations and supporting processes.

Major ICT strategic projects for the year included:

- Audit software programme

– an audit software solution that facilitates efficiencies and elevates the quality of our audits and reporting

- Information technology service management tool

– an industry-leading cloud-based system to manage ICT service desk requests and radically improve the way ICT resolves these calls

- Mimecast services

– aimed at an improved overall security

- Firewall replacement

– to improve security

Resolving IT audit findings

We resolved 96% of ICT audit findings due in March 2023 in a significant improvement from previous years. The security environment was also improved to include the following:

- Security plan and user awareness programme to ensure the confidentiality, integrity and availability of AGSA assets, as well as protecting the privacy of our stakeholders

- ISO 27001 adoption readiness and Control Objectives for Information and Related Technologies (COBIT) assessments were included into the security plan

- Granting of access rights to authenticated users as well as ports and sites by the improved firewall

- Network level authentication on all servers to reduce the risks of denial-of-service attacks on our environment

- Monthly security patches deployed to all operating systems except during freeze periods

- Security operation centre service by external party to detect and prevent any malicious activities on the network

- Prevention of malware and intrusions from external sources and to report exceptions through antivirus with network intrusion prevention signatures on all our servers

- Encryption of the access from the web browser to the web server application and database

- Backup and daily backup checklist.

The unit is working on getting to the maximum resolution of audit findings and maintaining the clean control environment. Cyber and data security improvement is an ongoing process through the implementation of the approved cybersecurity plan.

A new digital transformation unit

The objective of our new digital transformation unit is to transform the business by using fit-for-purpose technologies. This will result in automating business operations, insight and unlocking efficiencies to create a sustainable business model.

The core strategic objectives include:

- collaborating to identify organisational initiatives that extract business value from technology investments

- implementing software robotics that mimic user behaviour and connect multiple fragmented systems and sub-processes through automation

- implementing business intelligence and analytics

- leveraging technologies to give machines the ability to sense, comprehend, act and learn to mimic and expand human capabilities

- migrating relevant applications and data to the cloud with minimum disruption to business operations.

Audit quality

Ensure high quality of our audits

The quality of our audit work continues to be paramount as it ensures the credibility of our opinions and enhances our reputation. The work that we produce attracts significant attention, both from our auditees and from the public. We are mindful of the reality that our products and processes may be subject to increased scrutiny before the courts. We therefore make quality audits our priority.

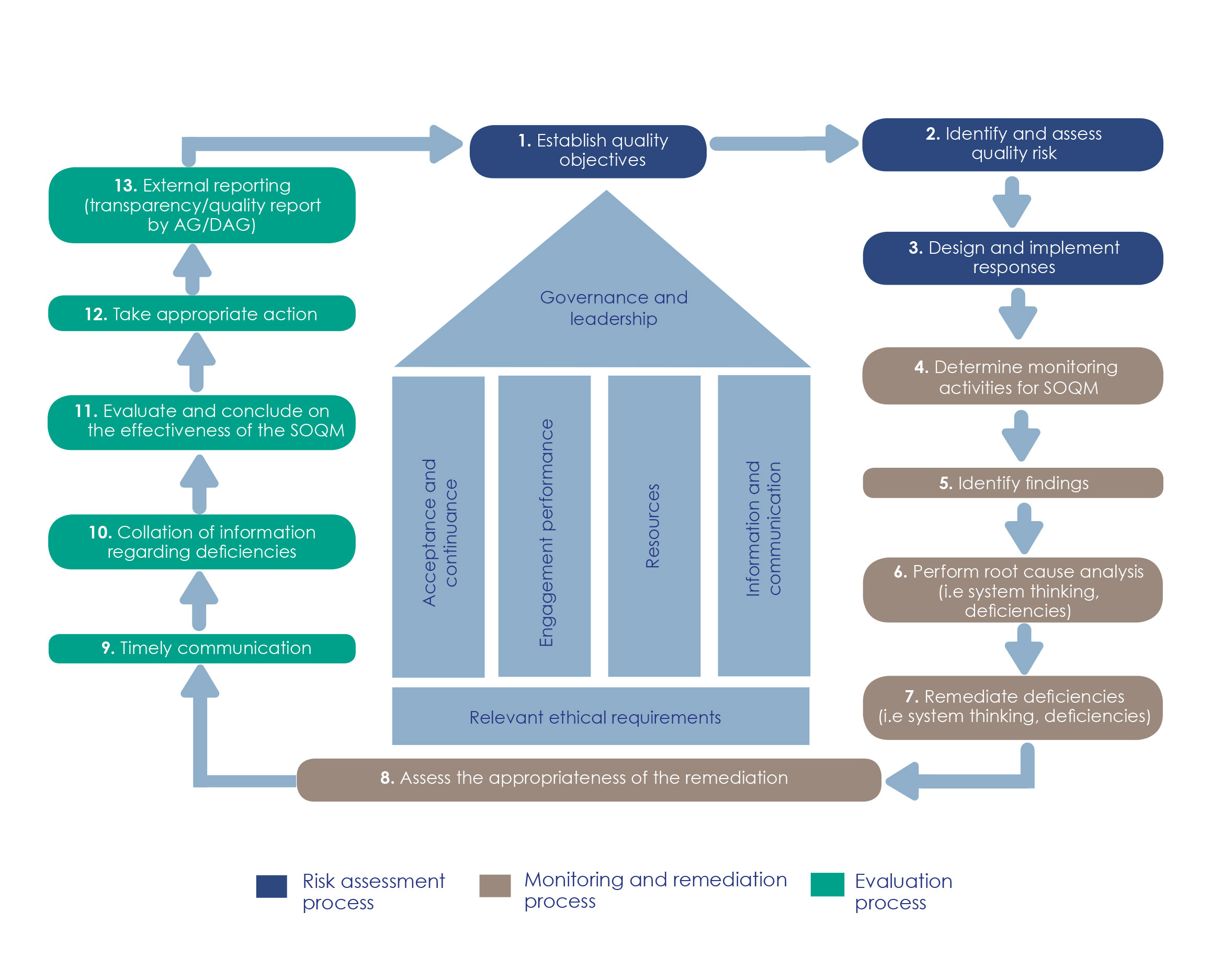

System of quality management

The new ISQM standard came into effect on 15 December 2022. To comply with and adopt the standard within the prescribed timeline, we developed an effective system of quality management.

We used a project management approach to implement the ISQM to ensure that we were business ready to comply with the standard by the effective date. While we experienced challenges, we became ISQM compliant ahead of the 15 December 2022 deadline.

We used a project management approach to implement the ISQM to ensure that we were business ready to comply with the standard by the effective date. While we experienced challenges, we became ISQM compliant ahead of the 15 December 2022 deadline.

The ISQM 1 implementation required a mind shift in how we navigate from a perceived reactive and negative quality control space to new ways of managing quality that is proactive, preventative and ensures collaborative engagement and accountability.

We conducted a comprehensive and iterative change impact assessment and prepared for applying the ISQM by training staff on the principles to strengthen systems of quality management.

This training reached 3 414 participants who spent a collective 6 690,17 hours on our eLearning platforms on the learning management systems (LMS), with a pass rate of 89%.

The information systems audit reimagine project aimed to redesign the current operating model and structure by conducting a skills gap assessment to ensure that the unit has the relevant future-ready IT auditing skills to meet the emerging technology demands and business needs. This project will continue into the 2023-24 performance year.

Initiatives to improve audit quality

- Audit quality indicators

– provide an early warning of potential threats to audit quality - Proactive audit quality reviews

– conducted by our technical audit support staff on specific areas in the audit files where audit

quality risks have been identified to influence higher quality audit files. The audit teams resolved

these findings prior to signing off the audit reports. Details of these findings were also shared across

the organisation to ensure that similar audit quality matters are addressed on audits that did not

undergo a proactive review - Remediation process

– to ensure that we have relevant, reliable, and timely information about the design, implementation and operation of the SOQM, and to take action to prevent findings from reoccurring

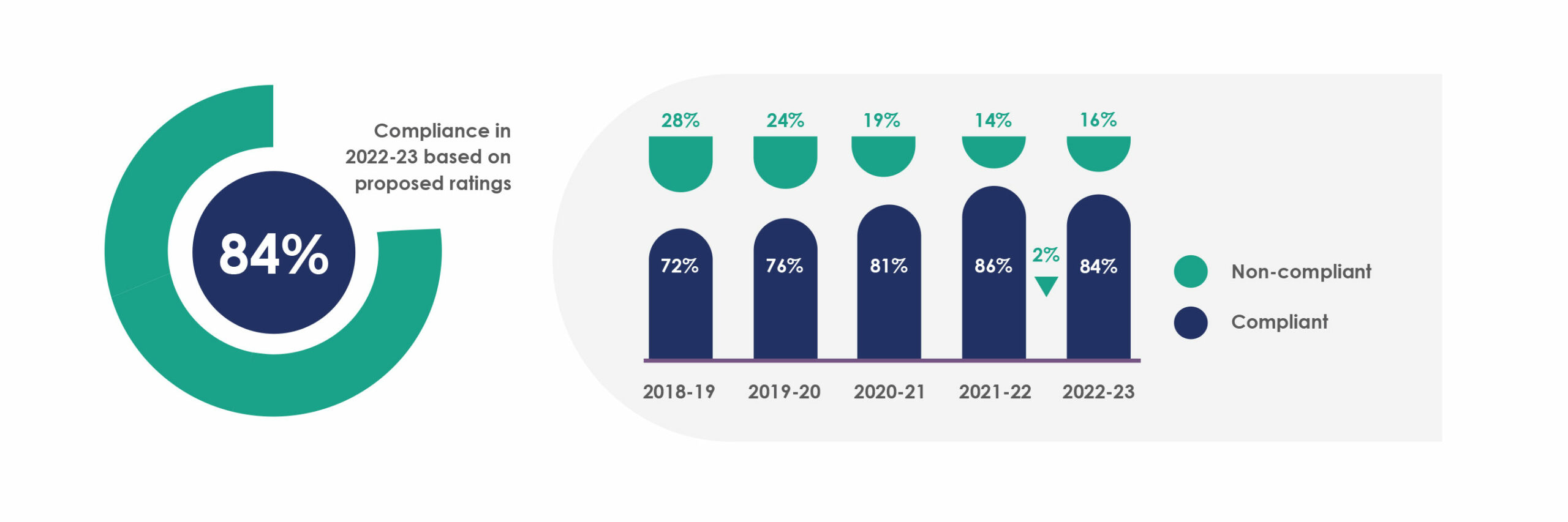

This year we subjected 64 audit engagement files for 63 engagement managers to a post-issuance quality review. We are proud to announce that we achieved a rating of 84% compliance with engagement quality standards for the 2022-23 performance year.

While this is a decline of 2% from our rating in the previous year, it is within the targeted achievement of 80% or more. We intend to improve on this year on year as we mature in the SOQM.

Overall, there has been a gradual and sustained improvement in the quality outcomes over the past five years, which can be attributed to our investment in specific initiatives that have been implemented and embedded in the organisation over the years.

Overall, there has been a gradual and sustained improvement in the quality outcomes over the past five years, which can be attributed to our investment in specific initiatives that have been implemented and embedded in the organisation over the years.

Risk management

Strategic risks

The organisation’s risk management processes are an integral and a fundamental tool for enabling organisational objectives and delivering on our strategy. During 2022-23, and as a consequence of the introduction of the ISQM 1, we reviewed and enhanced some policies and procedures – including our risk management policy – primarily to ensure that organisational risk management processes remain robust and proactively responsive to emerging environmental factors.

In developing and implementing the culture shift strategy, we set out to proactively identify strategic risks and implement measures to mitigate against the potential threats to the achievement of strategic objectives. We identified six strategic risks, including at the audit committee level, which has the ultimate responsibility of approving the strategic risk profile.

We are pleased to note that across the organisation and its various structures, there is an established culture of risk consciousness and intelligence. We believe that our collective attitude to risk management will safeguard the organisation and ensure its sustainability into the future. As depicted below, when the strategic risk profile was revised, a deliberate effort was made to ensure that there was an alignment between the strategic risk profile and the #cultureshift2030 strategy and its pillars or elements.

The risks are mostly influenced by the following factors:

- Emerging environmental factors as a result of our scanning exercises

- Continuous risk identification and risk monitoring

- An assessment of performance indicators

- An assessment of our risk appetite measures.

While the strategic risk profile has not significantly changed from last year, the average exposure associated with the six risks has increased, with none of the risks rated as low.

We continuously identify, evaluate, mitigate and report on risks as an important element of the overall risk management approach. We also continuously review and monitor the mitigations. The table below outlines the key responses attached to the strategic risks. Some key responses are initiatives to the #cultureshift2030 strategy.

| Risk description | Key response |

|---|---|

| Failure to remain relevant (high-impact outcomes) with regard to our product, insights or messages as well as our proactiveness |

|

| Unfavourable employee experience impacting on the delivery of the mandate |

|

| Negative financial viability |

|

| Negative impact on the credibility of the AGSA |

|

| Slow response to information technology needs impacting on efficiencies and achievement of organisational objectives |

|

| Non-adherence to quality standards |

|

In view of the above, and other mitigations on the strategic risk profile, we are satisfied that when implemented, the initiatives will enable the organisation to achieve its strategic objectives.

Managing ethical and independence risks

Our approach to building a strong ethical environment and influencing ethical behaviour in the auditing profession and in the environment in which we operate is guided by our dedicated ethics strategic programme. Through it we strengthen our leadership’s ability to deal with ethical issues and create mechanisms by which we will make our employees feel more valued and ensure that all AGSA employees, stakeholders, auditees and contractors adhere to and are held to the same standard of ethical conduct that is beyond reproach, in fact and in perception.

We proactively identify and respond to ethics risks by creating and sustaining an organisational environment with a common understanding and application of the AGSA’s ethical principles, with the specific goal of strengthening the character and ethical resolve of our employees to be steadfast against temptation and undue influence.

The International Ethics Standards Board for Accountants (IESBA) and the International Standard for Supreme Audit Institutions (ISSAI) 130 inform our ethical stance and are the foundation of our ethics management programme.

Our employees’ personal interests are captured and managed through our declarations system and are monitored quarterly via exception dashboards.

The compliance rate for the 2022-23 financial year is 99,7%. The declarations outstanding as at 31 March 2023 relate to employees on maternity, sick and unpaid leave, who are expected to comply upon their return to duty. One outstanding declaration relates to a new member of staff whose details had not yet been captured on the system.

We had two confirmed ethical breaches for the year:

| Summary of allegations | Ethical breach and actions taken |

|---|---|

| Complaint regarding the unfair allocation of work to a CWC firm |

|

| Suspected fraudulent payment of an employee’s salary into a third-party bank account |

|

The ethics programme also included ethics engagements with the firms contracted to perform audits on behalf of the AGSA and will be continued to ensure adherence, with the relevant provisions included as contractual obligations.

Organisation’s risk culture

In response to the organisational risk culture survey conducted in quarter 2 and 3, we have drafted a training and change plan that will be rolled out over the 2023-24 performance period.

Some of the interventions that will be rolled out include the following:

- Hosting risk management workshop, that will be open to all our key stakeholders

- Facilitating a risk champion awareness initiative; that will include clarity on their roles and responsibilities and how to apply the risk management process within their business units

- Supporting the champions with their responsibilities, to enable them to realise their risk management goals (given that risk management is included as a performance measure in their IPCs)

Furthermore, a fraud risk assessment was developed after a fraud risk survey was performed with representatives from business.

Status of audit findings resolutions

Of the 39 findings from internal and external auditors issued in the 2022-23 financial year, 28 (72%) were issued to the ICT function, mostly as a result of issues identified during the IT security review, undertaken by the internal auditors. The other 11 (28%) were issued to the Finance and Risk and Ethics units.

Of the 39 findings, 27 (69%) have been resolved and 12 (31%) are in progress. It should be noted that one finding emanating from the IT security review, which has previously been closed, has since been reopened given that a vulnerability scan indicated that the finding was not resolved sustainably. The team is investigating a sustainable remediation action.

Adequacy and effectiveness of our internal controls

With the internal controls monitoring process, we have a notable reduction in the level of reported exceptions, at 406 (40%), demonstrating a significant improvement in adherence to defined internal controls, policies and procedures.

Although this gives us a level of comfort, we remain conscious of all identified issues and their related root causes. Most of the issues are because of late approvals (time) and movements of assets. It should be noted that the identified issues are usually resolved within 30 days.

We are therefore reasonably comfortable that exceptions are generally detected early and resolved timeously. In line with the organisation’s digital transformation and automation efforts, the internal controls monitoring function is looking forward to implementing and embracing a new robot and a digital form to assist with improving efficiencies.

Status of compliance with the laws and regulations (mandatory or elective)

Our regulatory universe has no significant changes. We do not have legislation, standards or codes rated either critical or high; implying that our process on compliance management remains adequate and effective to mitigate against regulatory compliance risks.

Complaints statistics and trends

During 2022-23 we received 98 complaints. These were assessed and broken down as follows:

| Out of scope | Number |

|---|---|

| Referred to relevant authority | 46 |

| Audit tip-offs | 18 |

| TOTAL | 64 |

The majority of complaints are still reported through the AGSA’s website (58). However, most of these are classified as out of scope and are reported on this platform due to the accessibility of the website or the public’s misconception of the AGSA’s role.

The remaining 34 complaints were in scope. These were broken down as follows:

| In-scope | Number |

|---|---|

| Audit related complaints (Category 2) | 10 |

| Combination of conduct and audit related (Category 2 and 3) | 2 |

| Conduct and administration of the office (Category 3) | 22 |

| TOTAL | 34 |

Changes to the complaints policy

On 1 November 2022, the new dispute resolution policy came into effect to address audit-related complaints. The scope of the dispute resolution policy is to address disagreements between the audit teams and those they audit, where these disputes are not successfully resolved by audit business unit leaders. These complaints will be resolved by the complainant escalating the matter to the head of portfolio of the respective audit team for efficient resolution.

Promote the whistleblowing channel

Our whistleblowing platform remains an effective channel to report complaints relating to the conduct of AGSA employees and the office administration. This is enabled by the whistleblowing platform being completely anonymous.

In addition, our other channels to report these irregularities include:

- The AGSA website

- A dedicated AGSA ethics email address (ethics@agsa.co.za)

- Stakeholder walk-ins (particularly at the head office building)

Effectiveness of reporting channels

| Whistleblowing cases received from speak-up |

Cases received from the AGSA website |

Cases received from direct email and walk-ins |

||||||

|---|---|---|---|---|---|---|---|---|

|

|

|

Fraud prevention framework

The fraud prevention implementation plan was approved in July 2022 to support our Fraud Prevention Framework. The plan contains specific activities that were rolled out to the organisation to prevent the occurrence of occupation fraud. The majority of these activities have already been completed with the remaining activities being carried over into the new financial period.

Management of legal risk

Our ability to sustainably impact the lives of South Africans relies to a great extent on our independence. Attacks on our independence manifest in various forms. One is to disrupt our work and bring the credibility of our products into question. Our legal team is tasked with the responsibility to predict, prevent, identify and mitigate all legal risks that threaten our independence. Once a threat has materialised, the legal team defends our cases before the courts.

A change in legislation, court rulings that alter the law as we knew it, complex commercial transactions and employee concerns all create some form of legal risk or threat for the organisation. The most prominent, and possibly the most harmful are legal attacks on our audits.

During the 2022-23 financial year, our legal team identified jurisprudence and changes in legislation that affected our operations and the manner in which we execute our mandate. Our approach to these developments is one of proactive analysis and early preparation of the environment to ensure minimum risk of non-compliance when the changes in law take effect.

When considering legal risk in the context of our audits, we have sharpened our ability to resolve disputes as soon as they arise, or as early as possible thereafter.

Judicial review proceedings against our audit products not only compromise our ability to meet our legislated deadlines, but also threaten the institution’s guaranteed independent role in ensuring accountability, transparency and timely oversight by those charged with that responsibility. In 2022-23, the AGSA did not face any commercial legal attacks. We experienced legal challenges in the employment relations discipline and a handful of audits came under legal scrutiny.

The chief people officer (CPO) case

In June 2022, the former chief people officer (CPO) threatened the auditor-general with exposure of alleged ‘wrongdoings’ in exchange for financial rewards in a material ethical breach. The deputy auditor-general ordered an independent investigation by a prominent law firm, Bowman Gilfillan, into the threat and allegations. During the course of the investigation, the CPO’s former employer shared information that indicated several acts of impropriety by the former CPO, acts that he never declared to the AGSA during or after his appointment. The CPO was charged in a formal disciplinary hearing with gross misconduct, breach of his suspension conditions and gross dishonesty. He was subsequently dismissed and his services at the AGSA terminated on 28 September 2022.

The Road Accident Fund (RAF) case

We highlighted in last year’s integrated annual report the Road Accident Fund’s (RAF) judicial review of our 2020-21 audit report. The RAF has subsequently withdrawn its appeal against the high court order allowing publication of the report. However, the RAF persists in challenging the auditor-general’s decision to issue a disclaimer of opinion for the 2020-21 audit. The judicial review is set down for argument before the high court, and there is still no sign of withdrawal of the case.

The RAF’s continued use of its accounting policy, based on an inappropriate standard, led to another judicial attack on an urgent basis to prohibit the auditor-general from publishing the 2021-22 audit report.

In dismissing the RAF’s application, the court confirmed two fundamental principles:

- A legal attack against the submission of an audit report unduly hinders the auditor-general from performing her statutory duties and amounts to interference and, unless exceptional circumstances existed, would infringe on the principles governing the separation of powers.

- The Constitution demands swift, accurate and transparent reporting on the financial affairs of public entities. This requirement for transparent reporting, the judge argued, was even more acute in the current state of concern regarding the governance of public entities in the country.

Legal challenges are not only time consuming and costly, but also disrupt the normal course of the oversight process.

Legal challenges against the AGSA don’t always originate from disagreement with the way we work or the results of our work. During the current reporting period, Sakeliga NPC brought an application in terms of the Promotion of Access to Information Act, 2000 (PAIA) to gain access to the management reports of 154 municipalities for the financial years 2015 to 2022. Sakeliga also applied for an order to instruct the AGSA to make all management reports public going forward. We opposed this application on a number of grounds, including the impact that such orders would have on the ability and appetite of auditees to share information freely with the auditors. The high court ruled in our favour and confirmed that the Constitution did not require us to make our management reports public.

We encourage the users of our reports to engage in the rich information we report in our general reports. Our general reports contain auditee-specific insights that are adequate for the exercising of the rights of groups and individuals.

Conclusion and looking ahead

Our chief risk officer and his legal team identified and mitigated the legal risk that the institution faced, and safeguarded our ability to exercise our calling independently and without fear, favour or prejudice. We remain focused on closing the RAF review proceedings in respect of the 2020-21 and 2021-22 financial years and to keep our stakeholders informed. We similarly hope to close the review proceedings brought by the member of the executive council of the Department of Small Business Development, Tourism and Environmental Affairs (Destea).

We plan to review our litigation strategy during the course of 2023-24. The aim of this initiative is to ensure integration of our legal processes with the new audit dispute resolution process. The overarching aspiration is to eventually be free of any court challenges against our audits. This is not a pipe dream, if all relevant roleplayers in the ecosystem guide our auditees, support them, monitor their actions and use their enforcement powers in deserving cases.