The auditor general’s message

In these times of digital transformation, machine learning, artificial intelligence and large language models, the work in the national audit office requires certain fundamental traits such as diligence, tenacity, quality of work, integrity, and some non-traditional such as the ability to dream.

We dared to dream; to transform our environment and imagine a South Africa in which her people trust the integrity of their government, appreciate the accountability and transparency with which public resources are managed and, ultimately, enjoy access to basic service delivery.

The ability to dream, helped us see the end goal, and using our audit work, to assess the status quo in our environment against the end goal and to apply the insight gained to define tailored programmes for creating value for our stakeholders. I firmly believe that in turn our work impacts positively the achievement of the ambitions of our country’s National Development Plan and supports the improvement of the lives of the people of South Africa.

An important driver of the state’s capability to deliver services is the quality and strength of public service culture and the values embedded within it – particularly those of performance, accountability, transparency and integrity. This premise forms the foundation of our #cultureshift2030 strategy, developed in 2021.

During the 2022-23 reporting period, while unwaveringly executing our mandate, we focused on building the skills, capacity and capabilities required for us to successfully deliver our #cultureshift2030 strategy.

Accountability ecosystem

The theme of accountability ecosystem is not new. But for it to be fully integrated in the work of the public sector, it requires continuous reinforcement and buy in. All roleplayers that have a mandate or responsibility to drive, deepen and insist on public sector accountability, form an accountability ecosystem due to their mutually reinforcing connections and must work in sync for the greater good.

During the reporting period, we made a deliberate effort to formally outline the concept using familiar terminology and to bring it forward in every discussion, every interaction and every report or presentation.

We actively promoted the need for and encouraged all roleplayers in the public sector to diligently execute their responsibilities to ensure maximum positive impact on the success of our country and on the lives of the people of South Africa.

We made visible the strategic connections between the citizen’s service delivery expectations, the mandates of the various responsible players in government and society, the available accountability mechanisms and their effectiveness in driving transparent, responsive and prudent public financial management aimed at improving the well-being of our people as embedded in our Constitution.

We believe that regular, detailed assessment and reporting on the contribution of each player in the accountability ecosystem could lead to more effective shifts towards culture of accountability, transparency, integrity and performance.

Such annual assessments, and reports thereof will become an integral part of our value delivered to stakeholders.

How we added value through our work

The rigorous scrutiny of the accounting records and other related information to support financial statements and performance reports of almost 1000 institutions that we audited, resulted in two general reports being tabled in parliament. These serve as a state-of-governance account of how our government – at all three tiers – has spent taxpayers’ money during the audited period, provide a comprehensive analysis of the audit outcomes and represent the main source of insight into the stewardship of public funds in the country. This year, our general reports went further, to include a particular focus on service delivery.

Along with our key recommendations and government’s commitments, the insight into the impact of these results are meant to stimulate understanding and encourage a shift to a culture of accountability.

The insight garnered from the real-time audit on the use of the funds allocated for relief of damages caused by the floods in KwaZulu-Natal and the Eastern Cape elicited an admission by government that it was ill prepared to manage disasters. Extensive interactions with all our stakeholders gave our reports the necessary attention and influence to compel action.

Government made commitments that included stopping irregular contracts, withholding payments to suppliers until the work was completed, negotiating prices and applying other measures to minimise leakage and maximise the use of public funds on actual disaster relief for the people affected by the floods. We monitor these commitments on an ongoing basis.

Our relevant and actionable insight also focused on specific areas of public spending, especially those that make up the bulk of the budget and have the power to bring improvement in the lives of ordinary South Africans. We issued sector reports that provided detailed insight in the areas of transport, infrastructure, water, public works, IT, and state-owned entities to complement the national and provincial general report messages.

We issued a report on the rehabilitation of derelict and ownerless mines, which highlighted the health and safety concerns for local communities that live around these mines, and the economic impact of rehabilitating mines.

The strength of our messages increased with the application of targeted data analytics. We tested new analytics tools that enabled us to analyse vast volumes of data for more advanced analytics, including machine learning, enhanced spatial analysis and text mining. In one interesting case, we were able to detect symptoms of “local state capture”, which included collusion, preferential treatment, bid rigging and cover quoting, among others.

We continued to enable oversight by sharing the audit outcomes and providing rich insight to drive understanding and action, and are particularly pleased to observe that our investment in enhancing the capabilities of portfolio committees and committee support staff is yielding positive results.

Implementing our extended powers

In 2022-23 we reached our target to implement our material irregularity process at 202 public sector institutions that we audit in national and provincial government, and 170 in local government. We are on track to implement this process at all 879 institutions that we audit in the 2024-25 financial year.

Legal challenges

Judicial review proceedings against our audit products not only compromise our ability to meet our legislated deadlines, but also threaten the institution’s guaranteed independent role in ensuring accountability, transparency and timely oversight by those charged with that responsibility. A case in point is the Road Accident Fund, which persists in challenging my

decision to issue a disclaimer of opinion for the 2020-21 audit despite a high court order allowing publication of the report.

Legal challenges against our work present opportunities for key roleplayers in the accountability ecosystem to participate in resolving disputes, shifting a culture of resistance against our work to a culture characterised by responsible public financial management and embracing the AGSA’s insight.

I commend the parliamentary oversight structures, Scopa and Scoag in particular. These committees demonstrated what active and effective oversight means through active committee hearings and oversight visits related to the RAF’s performance, which included important reflections on the case against the AGSA and other organs of state.

We remain mindful of the possibility that our referrals, remedial action and certificates of debt arising from our extended powers may be scrutinised by the courts. Currently, we have had no indication of legal action from our enforcement, even though we referred several matters to other public bodies for investigation and have taken remedial action for the failure of some accounting officers to heed our recommendations. We appreciate the cooperation of various role players and remain on high alert as we approach the consideration of the first certificate of debt during the course of the 2023-24 financial year.

We have revised our audit dispute resolution mechanism, which is succinct and allows for greater leadership visibility through a tiered escalation approach. Ultimately, our desire is that the new process will significantly reduce the appetite to litigate against our audit outcomes. It is too soon to express a conclusive view on the effectiveness of the revised dispute resolution mechanism. However, I am encouraged by the early signs that it may counter the growing trend of litigation against our audit products.

Future audit focus

While comprehensive audit plans have always been in place, we have now begun to align our audits with a long-term plan to ensure relevance, consistency and continuity of audit messages, and, most importantly, impact of our audits. The long-term approach will also demonstrate the transparency of our choices, the allocation of limited organisational resources to auditing what matters and the expected impact on service delivery as the vehicle to improving people’s lives

I am pleased to report that we were able to close favourably on the widely published case of egregious breach of integrity of one of our executives. Our reputation remains untainted. We calmly followed the letter of the law and continued throughout to execute our mandate without fear, favour or prejudice.

Conclusion

The work of the national audit office is not a solitary assignment. We depend on the work and collaboration of every single role player in the accountability ecosystem for our common success for the benefit and well-being of our people.

We call on all relevant stakeholders to share our dream and joins us on the journey towards a better South Africa.

About our report

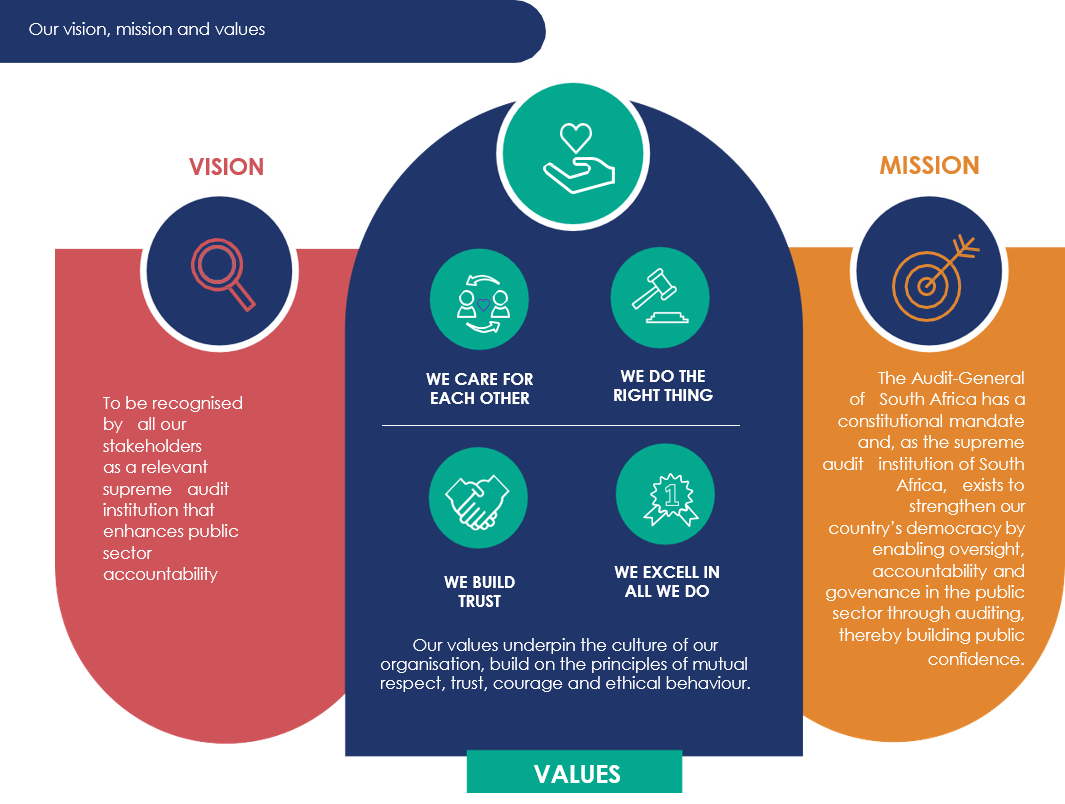

Our integrated annual report represents our account to Parliament and the people of South Africa on the fulfilment of our constitutional mandate and our promise to strengthen our country’s democracy by enabling oversight, accountability and governance in the public sector through auditing, thereby building public confidence.

The report is the result of a systematic reporting process that involves various levels in the organisation, making it a truly collective effort. Our executive committee leads the reporting process; its members are also active contributors to the content of the report, demonstrating the importance of accountability and transparency practiced in the national audit office.

Reporting period (GRI 102-52)

This integrated annual report provides a concise and balanced account of our performance from 1 April 2022 to 31 March 2023 against the commitments outlined in the 2022-25 Strategic plan and budget.

Where relevant for the formulation of a complete view of reported matter, some material events after the date of the financial year and up to the approval of this report by the auditor-general on 31 August 2023 have also been reflected in the report.

Integrated approach to materiality, reporting principles and practice (GRI 102-46, 102-54)

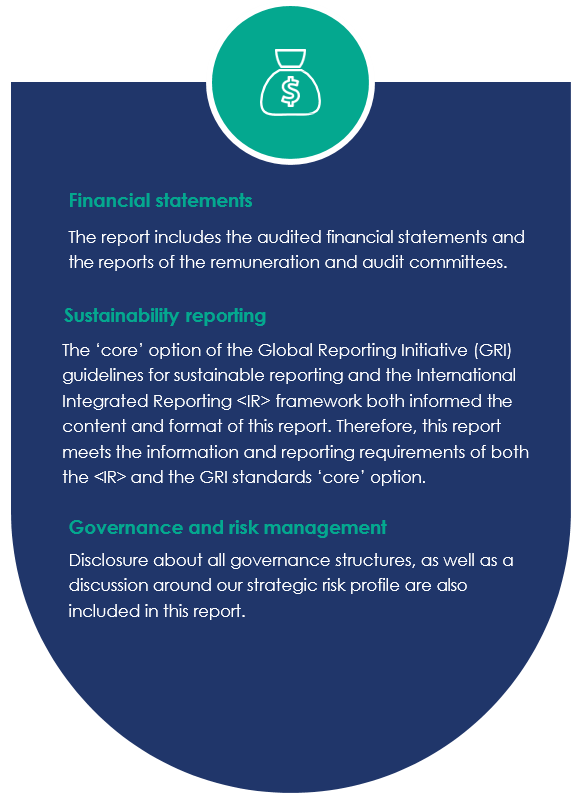

Our integrated approach to reporting is a result of applying integrated thinking to defining the imperatives for creating long-term, sustainable value for our stakeholders. This report covers the performance of all AGSA business units, including our head office and our offices across the nine provinces.

The report reflects the requirements of our governing legislation, the PAA, and the principles of the King IV code on corporate governance and reporting. The financial statements are prepared according to the International Financial Reporting Standards (IFRS) and the PAA.

Our material focus and the process to determine the content of this report

We identify issues that have the potential to impact our sustainability, i.e. our ability to create, preserve or erode value for our stakeholders. We prioritise those with the greatest relevance in our operating context as material matters. These matters generally relate to our financial and performance management, as well as the risks and opportunities that inform the scenarios we may face in the future.

We assess the matter continually to ensure that we remain relevant, to inform our strategy, the movement of our six capitals and our performance targets.

The material topics reported on in this report were defined by our executive committee in the strategic commitments made to Parliament, which are based on our long-term strategy and outlined in detail in the AGSA’s 2022-25 Strategic plan and budget. We confirmed these during the Exco meeting on 23 March 2023 where the annual report blueprint was approved.

The material aspects are applicable to all AGSA business units and all our key stakeholders. We therefore continuously engage with our stakeholders to find out what is important to them so that we can respond to their needs.

We did not need any restatements from our previous integrated annual reports.

Forward-looking statements

The report contains certain forward-looking statements on our financial condition, performance results and operations. They are based on our current beliefs and expectations of future events. These forecasts involve risk and uncertainty as they relate to events and depend on circumstances that are expected to occur in the future, many of which could be beyond our control. There are various factors that could cause actual results or developments to differ materially from those expressed or implied by these forward-looking statements.

Significant changes during the reporting period

2022-23 financial year was a transitional stage used to prepare the organisation for the implementation of our #cultureshift2030 strategy which guides our activities for the next 6 years in pursuit of high impact outcomes. To drive and deepen public sector accountability, we drove message around the roles and responsibilities of various players in the accountability ecosystem with the aim of changing the public sector culture.

The revised standard on risk assessment (ISA 315) required a major change in methodology and application. The changes were implemented in the working papers for 2022-23 and the development of the training material was completed.

We began to work on the re-design of our funding model which will allow us to have sufficient access to funds needed for the implementation of our culture shift strategy. This major effort will be adequately covered in our next annual report.

Feedback on our report

We welcome feedback on our integrated reporting to ensure that we continue to disclose information that is pertinent to all our stakeholders. Should you wish to provide written feedback, kindly use our email address agsa@agsa.co.za or our twitter account @AuditorGen_SA.

External assurance of information (GRI 102-56)

We adhere to the principles of good governance. Our combined assurance model defines the various role players that provide assurance to the AGSA, which include management, internal specialists, actuaries, the independent quality management assessment committee (QMAC), internal audit, external audit and the audit committee.

An independent external auditor audits our financial statements, financial management and performance information, and provides limited assurance on the selected sustainability performance indicators.

The assurance on this report was conducted according to the International Standards on Assurance Engagements 3000 (ISAE 3000: revised), issued by the International Auditing and Assurance Standards Board. The external auditor’s report is on page xx of this report.

Relationship between the organisation and the assurance providers (GRI 102-56)

The external auditor is completely independent of the organisation. The firm does not receiveany allocation of audits to be done on behalf of the AGSA and its income from auditing the AGSA is XX% of the firm’s annual revenue.

Scoag’s and the audit committee’s contribution to the assurance on the organisation’s sustainability report (GRI 102-56)

Scoag, which oversees the AGSA’s work on behalf of Parliament, appoints the external auditor for five years (renewable once) and confirms its appointment every year.

The audit committee facilitates contracting the external auditor on behalf of Scoag in a process that is fair, equitable, transparent, efficient and effective and in line with our transformation agenda.

The audit committee also examines the auditor’s capacity and competence to provide assurance on the sustainability infor- mation it reports on as part of its annual report to Scoag. information it reports on as part of its annual report to Scoag.

Approval of the report

The deputy auditor-general and auditor-general have applied themselves to ensure the integrity of the 2022-23 Integrated annual report. They have considered the completeness of the material aspects addressed in the report and the reliability of the reported performance information presented based on the combined assurance process. Accordingly, the deputy auditor-general and the auditor-general are satisfied that the 2022-23 Integrated annual report provides a fair and balanced account of the AGSA’s performance on those material matters that have been assessed as having a bearing on the AGSA’s capacity to create value.

We are also satisfied that the delegation of authority framework has contributed to role clarity and the effective exercise of authority and responsibilities by the relevant individuals and committees.

This report reflects the requirements of our governing legislation, the PAA, and has been prepared according to the GRI standards’ ‘core’ option and the

Signed: Deputy Auditor-General

Signed: Auditor-General

Our mandate and legal form

The AGSA is South Africa’s supreme audit institution, with a mandate stemming from chapter 9 of the Constitution of the Republic of South Africa, 1996. This makes us one of six state institutions that support constitutional democracy.

The Constitution entrenches the AGSA’s independence, subject only to the Constitution and the law. In turn, the Constitution requires us to be impartial, and to exercise our powers and perform our functions without fear, favour or prejudice.

The AGSA is an organ of state as defined by sub section 239(b i) of the Constitution, has full legal capacity and acts as a juristic person.

Accountability and reporting (GRI 102-1)

We account to the National Assembly by tabling our annual report, financial statements and the audit report on those financial statements. This requirement is governed by sub section 10(2)(b) of the Public Audit Act 25 of 2004 (PAA).

Our functions, beneficiaries and products (GRI 102-2)

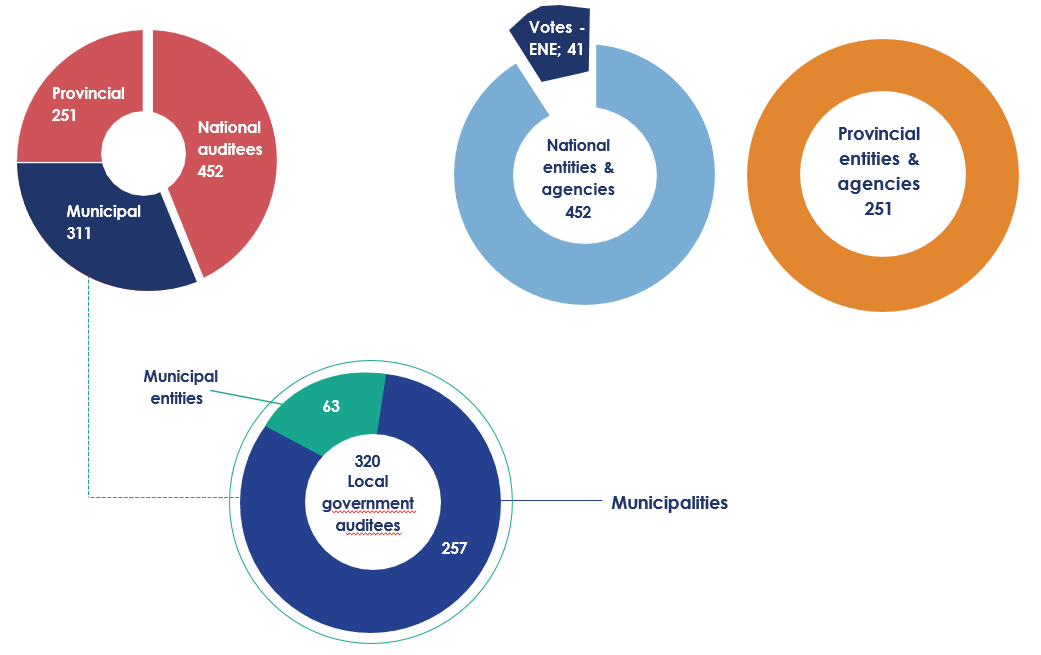

Section 188 of the Constitution describes our functions and chapters 2 and 3 of the PAA regulates the powers necessary to perform them. By law, we audit and report on how the government spends the South African taxpayers’ money. Every year, we audit national and provincial government departments, certain public entities, municipalities and municipal entities (our auditees).

We issue audit reports that provide them with the outcomes of our audits and emphasise material irregularities where we find them.

According to section 1(1) of the PAA, a material irregularity (MI) occurs when:

- a person does not comply with or contravenes legislation, engages in fraud or theft, or violates their entrusted duty

- this action can or does result in a significant financial loss, the misuse or loss of a significant public resource or substantial harm to a public sector institution or the general public

- the action is identified during an audit performed under the PAA

When our outcomes include MIs, we can either refer them to public bodies for investigation or include recommendations to address them in the audit report. In the case of the latter, if our recommendations are not implemented, we take binding remedial action.

Where the accounting officer or authority does not implement the remedial action, the auditor-general can issue a certificate of debt to recover money lost from accounting officers or authorities.

Definitions

Binding remedial action: directs the accounting officer or authority to address cases where our recommendations are not implemented. In the case of a financial loss, the accountable officer must calculate the loss and recover it from the person responsible.

A certificate of debt is a certificate issued in terms of section 5B(1) of the Act when remedial action has not been taken. It requires the accounting officer or authority to repay the specified financial loss to the State.

Definitions

Regularity audit, or financial audit, is our mandated examination and reporting on an auditee’s financial statements. It also examines the auditee’s compliance with relevant legislation and its reporting on its performance against its own predetermined objectives.

Specialised Audit services is a division of the AGSA that nurtures and provides specialised skills and techniques for in-depth audits based on the autitee risk profile. These audits can be stand-alone or integrated with regularity audits and other discretionary audits. The three specialised audit services business units are investigations, information system audit and performance audit.

We undertake two main types of audits: financial audits and discretionary audits, such as performance audits, special audits and investigations.

All our reports are meant to help the legislature call the executive to account for the way they manage public funds.

Auditees include our financial audit reports in their respective annual reports, which they table in their relevant legislature (National Assembly, provincial legislatures or municipal councils). The reports may also be made available to bodies with a direct interest in the particular audit and to any other legislature or organ of state if we consider it in the public interest to do so.

In addition to these audit reports, we publish general reports in which we analyse the outcomes of the financial audits at national, provincial and municipal levels, and special reports that analyse our findings from real-time or other stand-alone discretionary audits.

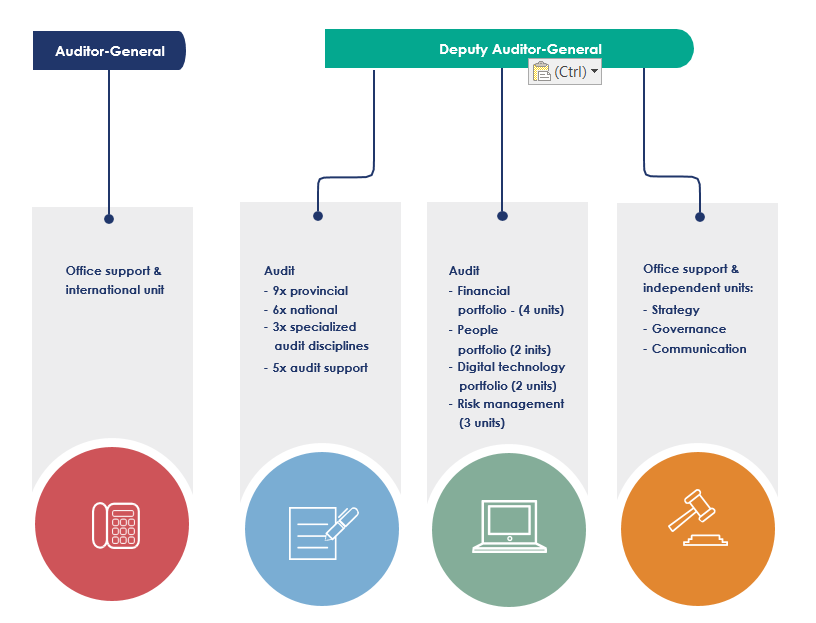

The way we are organised

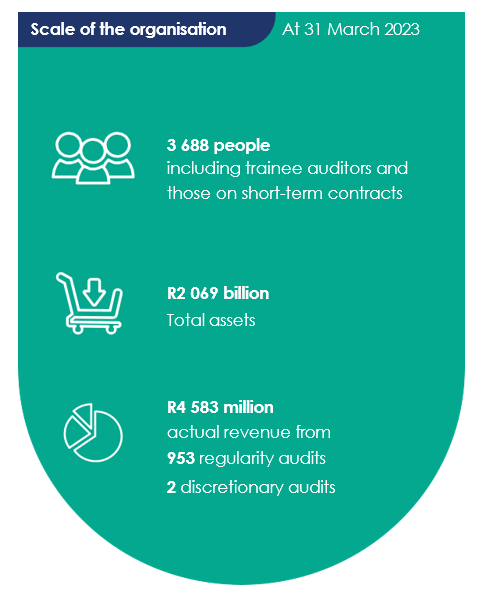

The way we are organised (GRI 102-3,102-4, 102-7)

The AGSA is based in South Africa and delivers services that

benefit the people of our country. By implication, the work that we do in enabling good governance and accountability in the pub- lic sector, in creating professional public auditors, developing best practice in public auditing and running a supreme audit institution benefits the global community as well.

Our head office is in Pretoria. We have a regional office in each of the nine provinces to ensure that we are accessible to our clients and deliver our services in the most efficient and effective manner.

The business operations of some of our auditees require us to audit elsewhere in the world.

Structure of the AGSA

Scale and complexity of our audit work

As part of our mandate we audit a large number of clients with different complexity and nature of business.

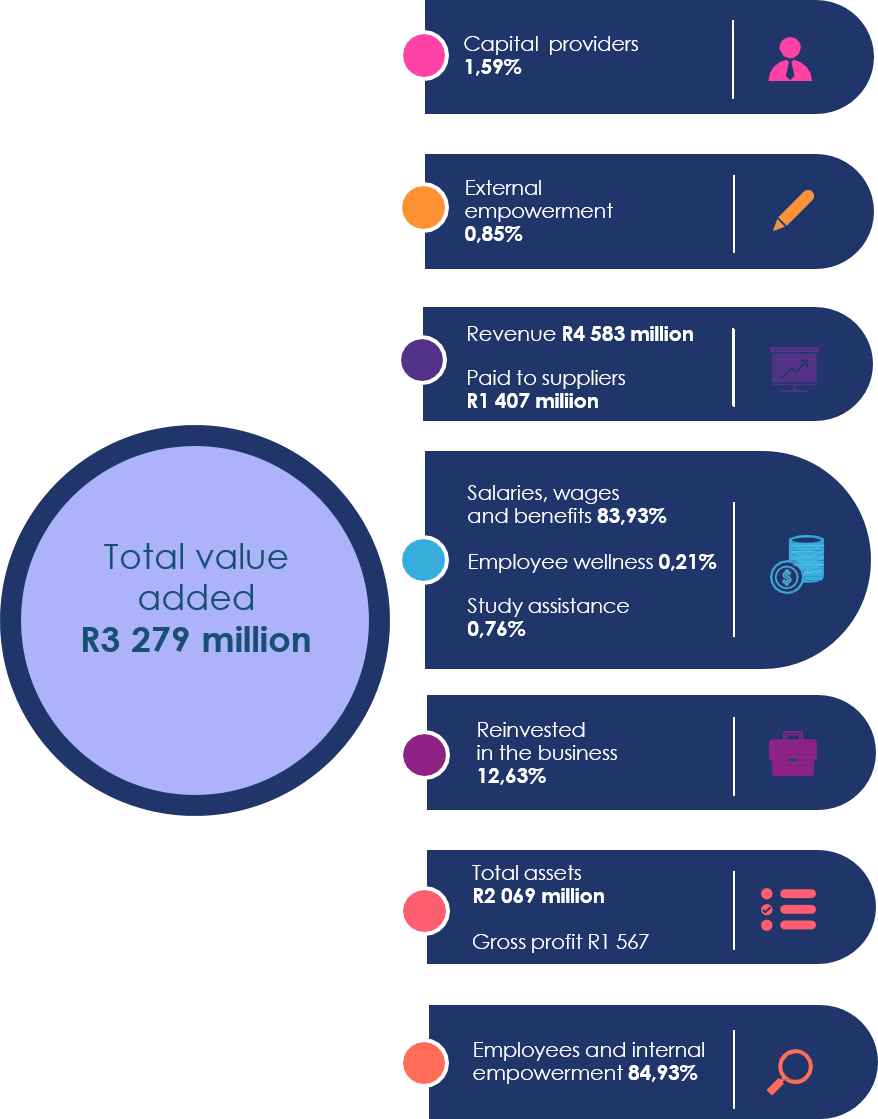

External charters and value added statement

External charters, principles and initiatives that we subscribe to or endorse

The AGSA is an active member of Intosai. We lead the capacity building committee (CBC), which is Intosai’s advocate and custodian for SAI capacity development. The AGSA participate in several of Intosai’s working groups, aimed at exchanging ideas, knowledge and experience between its members as well as working on finding common solutions to identified challenges. We host the secretariat of the African Organisation of English-speaking Supreme Audit Institutions (Afrosai-e), a regional chapter of Intosai.

We subscribe to the following standards and principles:

2022-23 Value-added statement

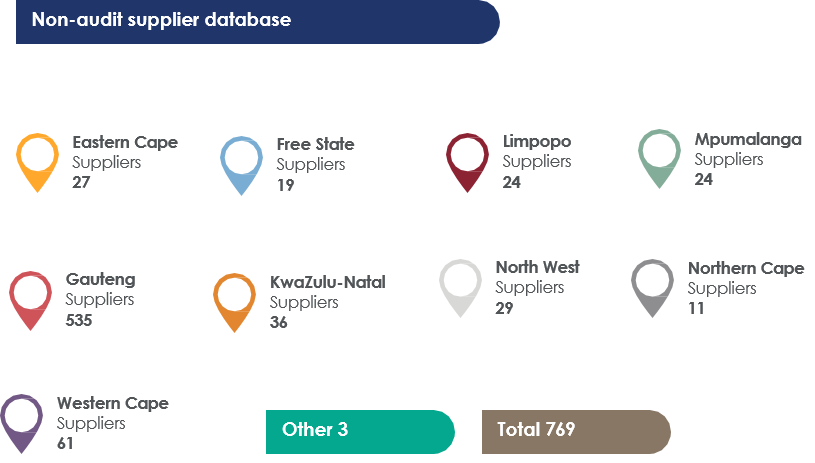

Organisation’s supply chain

Organisation’s supply chain

In line with the principles prescribed in the Constitution, we maintain a procurement and provisioning system that is

fair, equitable, transparent, competitive and cost-effective.

Audit contracts awarded

As part of our business model, we outsource some of our audit work. The firms that audit on our behalf are appointed using a transparent selection process that considers their size, location, expertise and quality of audit work.

The appointment process also incorporates the principles of transformation to develop, grow and advance black chartered accountants.

Outsourced work 1 included pre-issuance reviews, regularity audits, information systems audits and performance audits.

Our vendor and service providers vetting system features enhance probity checks on all prospective service providers, vendors and their directors. In our quest to lead by example, we apply key principles emanating from the work of the Commission of inquiry into state capture, being pedantic in detecting possible conflicts of interest.

During the reporting period, we conducted a thorough review of all service providers and vendors registered on our system and improved its status by removing duplicated names captured for various categories in the system, deactivating 1832 service providers that had not been used for over a year, e.g. rotated out committee member, students, pre-issuance reviewers, etc. which resulted in a lean, easily manageable supplier data base.

We safeguard against paying a high premium for goods and services received. Our legal team negotiates all contracts with a value above R1 million.

Over the last year, the re-negotiation of leases for six of our offices resulted in a combined savings of R53,7 million to be realised over the respective terms of the leases.

2022-23 spend on core audit work by private firms:

A competitive and compliant procurement process for our group risk benefits allowed us to save more than 33% on premiums currently paid for similar benefits.

Our digital transformation strategy is based on the phasing in of new audit tools and technologies that will allow us to audit more efficiently and generate unique audit insight for the

benefit of our stakeholders.

Major procurements processes include our Audit software replacement, Data Snipper tool, enterprise-wide project management office system, financial strategy and funding model development and the managed security services for the AGSA’s IT environment.