AGSA executive committee

The PAA gives both the auditor-general and the deputy auditor-general the authority to delegate their assigned powers or duties to any member of staff.

The executive committee (exco) assists the deputy auditor-general to manage the business affairs of the organisation, in line with the delegation of authority set out in the AGSA management approval framework. It also has the power to establish subcommittees to assist it.

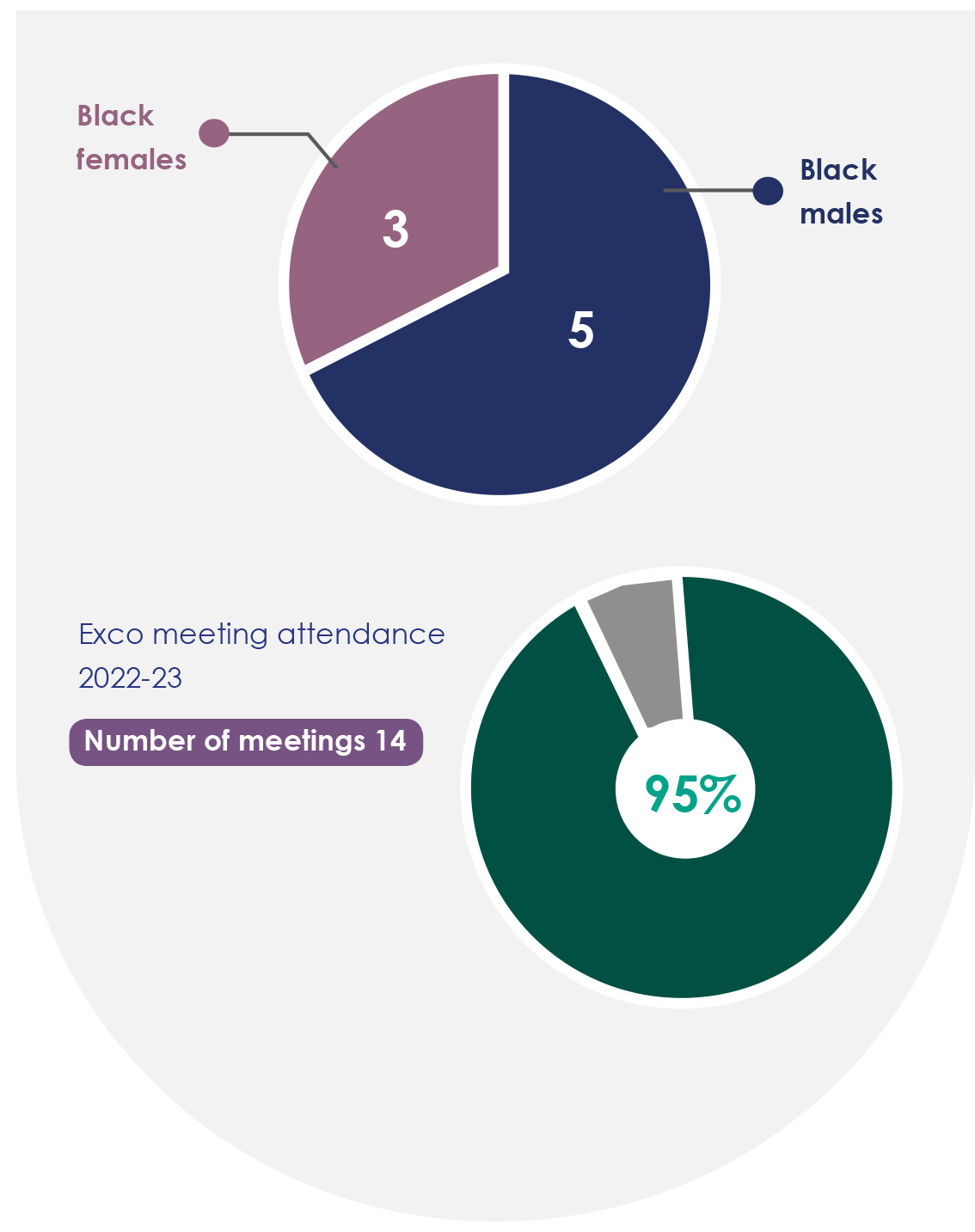

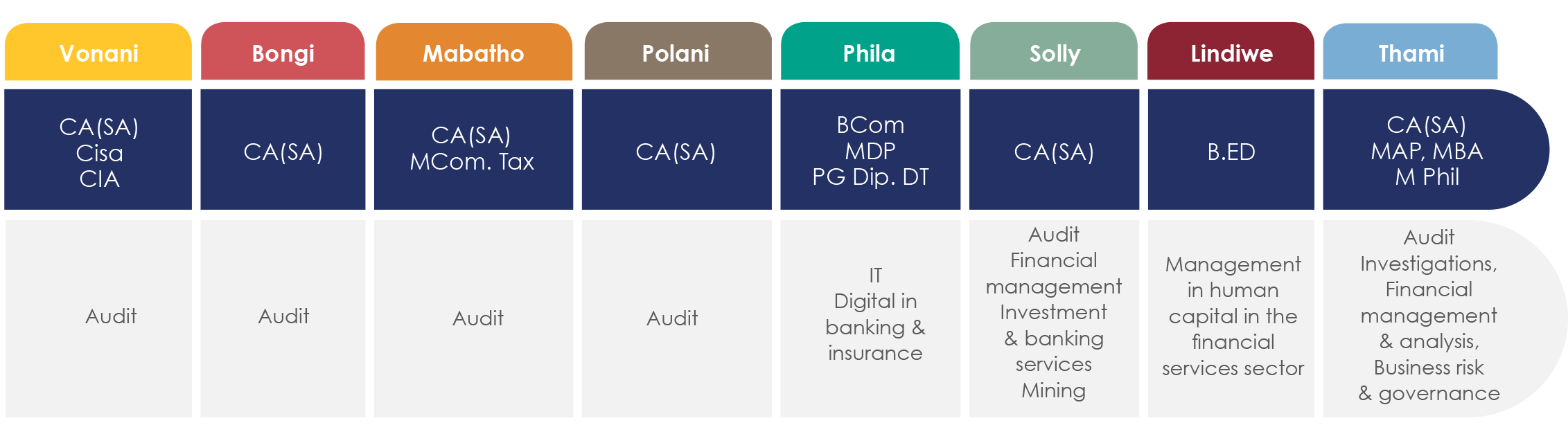

Chaired by the deputy auditor-general, exco consists of the two heads of audit and the five chief officers.

Exco meets regularly during the year.

Experience

Our diversity targets for black women exco members have been met.

The way we are organised

The way we are organised

The AGSA is based in South Africa and delivers services that benefit the people of our country.

By implication, the work that we do in enabling good governance and accountability in the public sector, in creating professional public auditors, developing best practice in public auditing and running a supreme audit institution benefits the global community as well.

Our head office is in Pretoria. We have a regional office in each of the nine provinces to ensure that we are accessible to our clients and deliver our services in the most efficient and effective manner.

The business operations of some of our auditees require us to audit elsewhere in the world.

Scale and complexity of our audit work

As part of our mandate we audit a large number of clients, each with different complexities based on the nature of their business.

Our governance framework

Our governance framework is defined by the Constitution, PAA, certain regulations issued in terms of the PAA and good governance best practices.

We fully adhere to most King IV principles, and partially comply with 8, 9 and 10.

In line with best practice, we rotate the members of our governance structures and perform annual independent reviews of their effectiveness.

We also regularly fine-tune our internal governance framework to enhance our leadership decision-making processes.

Standing committee on the auditor-general

Scoag consists of the following honourable members of parliament and political parties:

- ANC

- Mr SS Somyo

- (Chairperson)

- Mr JB Mamabolo

- Mr OM Mathafa

- Mr Z Mlenzana

- Ms PT Mpushe

- Ms C Seoposengwe

- Ms DJ Myolwa

- AIC

- Mr SM Jafta

- DA

- Mr MH Hoosen

- Ms SP Kopane

- EFF

- Ms NV Mente

- Ms NKF Hlonyana

- (Alternate member)

- IFP

- Mr N Singh

From 1 April 2022 to 31 March 2023, Scoag considered the following AGSA briefings and matters:

- Local government audit outcomes and findings on covid-19 municipal relief funds

- Integrated annual report 2021-22, audit committee report, 2023-26 strategic plan and budget and audit directive

- 2021-22 national and provincial

Scoag Is an oversight mechanism aligned to the provisions of section 55(2)(b)(ii) of the Constitution and section 10(3) of the PAA.

Mandate:

- Advise the National Assembly

- Approve a financial reporting framework for the AGSA

- Agree to the AGSA retaining any surplus at the end of a financial year

- Assist and protect the auditor-general to ensure independence, impartiality, dignity and effectiveness

- Recommend the conditions of employment of the auditor-general to the president

- Provide general oversight

- Confirm the five-year appointment of an independent firm of external auditors and review it annually

- Comment on a code of conduct for authorised auditors appointed by the auditor-general

- Comment on the mechanism for handling complaints on the manner in which the AGSA performs its audits

- Comment on the basis for calculating audit fees

- Comment on regulations that the auditor-general makes in terms of the PAA

- Consider the audit committee’s concerns

- Consider the auditor-general’s annual report, financial statements and audit report

- Consider the deputy auditor-general’s reports on actual or pending under-collection, shortfalls on the budgeted revenue and overspending or expenditure not in line with the AGSA’s budget

- Consider reports from the deputy auditor-general on decisions the auditor-general took that are likely to result in irregular or fruitless and wasteful expenditure

Audit committee

The committee consists of three independent, non-executive members. Their skills and competencies are aligned to their duties and cover business, financial and risk management matters.

Members:

CA(SA)

Appointed 2014 Attendance: 80%

Experience: Audit partner for 13 years. Retired as a non-executive director of a JSE-listed REIT and chaired its audit committee for 10 years

R364 197

CA(SA) MPhil, AMP

Appointed 2022 Attendance: 100%

Experience: Financial director with 26 years of business experience from both the public and private sectors in areas that include credit risk, financial analysis, financial management and reporting, auditing, corporate governance and supply chain

R208 065

BSc Hons, MSc, MBL

Appointed 2016 Attendance: 100%

Experience: On an executive level in business strategy and operations with specialisation in supply and value chain management, and an experienced committee member in both the public and private sectors

R292 892

CA(SA)

Appointed 2018 Attendance: 100%

Experience: Over 20 years, in areas that include debt and equity structuring, auditing risk, and financial management

R333 864

* Mr John Biesman-Simons’ term as the audit committee chairperson came to an end in July 2022. Ms Grathel Motau took over his duties effective from 1 November 2022.

Mandate:

The audit committee reports to the auditor-general and Scoag on:

- whether our internal controls and risk management are adequate and effective

- its evaluation of our annual financial statements

- its opinion of whether our chief financial officer and finance function have the necessary financial expertise to fulfil their responsibilities.

The audit committee met five times during the year to consider, and where appropriate, approve:

- the status of our internal controls and risk management

- the progress of the internal and external audits

- the integrated annual report and audited financial statements

- our sustainability and performance information

- our internal and external audit work plan

- our recommendation to Scoag to appoint the external auditor and their work plan

- our chief financial officer and finance function’s financial expertise to fulfil their responsibilities

- our complaints management

- the early adoption of new accounting standards

- the mitigation we implemented to improve quality control

- the resolution of the former chief people officer’s allegations against the auditor-general

The AGSA remunerates external committee members in line with the approved South African Institute of Chartered Accountants (Saica) rates. Members are paid an hourly rate of R3 201 for the duration of a meeting and preparation.

The audit committee’s full report is presented on page 116 of the report.

Quality management assessment committee

Mandate:

The QMAC oversees the system of quality control at the AGSA.

The QMAC assesses quality control based on input from our Quality Management business unit and the Independent Regulatory Board for Auditors (IRBA) standards and legal requirements, and that our audit reports are in line with accepted international standards.

All quality control monitoring review reports are submitted to the QMAC annually, which considers whether the Quality Management business unit has correctly evaluated the quality assessment ratings for those engagement managers subjected to a quality review. The QMAC also reviews and approves our policies and processes for monitoring quality compliance.

The QMAC consists of the auditor-general, the deputy auditor-general, a member of the audit committee and an additional external member co-opted by the auditor-general

Members:

CA(SA)

Appointed 2021 Attendance: 100%

CA(SA), Cisa, CIA

Appointed 2022 Attendance: 100%

CA(SA)

Appointed 2013 Attendance: 100%

Experience: Audit partner for 13 years.

Retired as a non-executive director of a

JSE-listed REIT and chaired its audit

committee for 10 years

R42 253

CA(SA)

Appointed 2015 Attendance: 100%

Experience: Serving on the boards of a number of JSE-listed companies, often chairing their audit committees

R42 253

* Mr John Biesman-Simons’ term in the committee was directly linked to his position as the audit committee chairperson which came to an end in July 2022. The 2022-23 financial year was the last year he served as a member of QMAC

Mandate:

The audit committee reports to the auditor-general and Scoag on:

- whether our internal controls and risk management are adequate and effective

- its evaluation of our annual financial statements

- its opinion of whether our chief financial officer and finance function have the necessary financial expertise to fulfil their responsibilities.

At its meetings held on 14 June 2022 and 28 June 2022 the QMAC finalised the assessment results of a sample of our audit engagements reviewed in the 2021-22 performance year. The main points of deliberation were:

- the policy on monitoring quality compliance

- the report on the legal assessment into the root causes for the quality failures allocated during the 2021-22 review cycle

- the quality review process and the assessment criteria

- the report on the peer review of internal quality reviewers

- a consideration of review reports, review statistics and overall results and final decisions on proposed ratings for the 2020-21 audit cycle

- the possible impact of findings on policies and procedures, and on quality policies

- scheduling 2022-23 reviews

Members are paid an hourly rate of R3 201 for the duration of a meeting and meeting preparation according to the approved Saica rates for 2022-23.

The results are reported under performance information on Audit quality management on page 96 of the report.

Remuneration committee

Members

BSc (Env. Sci), MBA

Appointed 2021 Attendance: 100%

Experience: 15 years’ executive experience, former chairperson of the Commission of Employment Equity. Heads the SPI Board practice

Paid: Nil

CA(SA), B Admin (Hons)

Appointed 2022 Attendance: 80%

Experience: 30 years across diverse sectors of the economy as an audit partner and on various ethics and transformation, and remuneration committees

R96 030

PDM, GRP, B Soc. Science Master Reward

Specialist

Appointed 2014 Attendance 40%

Experience: 10 years of generalist HR experience and over 15 years in specialist remuneration

R12 804

CA(SA), Cisa, CIA

Attendance: 100%

Mandate:The auditor-general determines the terms and conditions of employment of all employees in the organisation.

The remuneration committee (remco) provides the auditor-general with specialised advice on remuneration and related issues, which is considered before the auditor-general makes a final decision.

It also provides advice on industry developments in remuneration frameworks. The remuneration committee is reviewed annually for independence.

In addition, the amended PAA mandates remco to make recommendations to the independent commission for the remuneration of public office bearers on the salary, allowances and benefits of the auditor-general.

During the year, the committee met three times to deliberate on the following areas:

- Annual salary increase and performance bonuses

- Financial position update and the scenario planning going forward

- Employee engagement plans

- Consideration of consultation process for the auditorgeneral’s remuneration

Members are paid an hourly rate of R3 201 for the duration of a meeting and meeting preparation according to the approved Saica rates for 2022-23.

The committee’s report can be found on page 120 of the report.

Committee reports

AUDIT COMMITTEE REPORT

Introduction

This report of the audit committee (the committee) is prepared and based on the requirements of section 40 (6)(a) of the Public Audit Act 25 of 2004 (PAA), as well as its terms of reference, which are reviewed and approved on an annual basis.

According to Principle 15 of the King IV code of governance, the governing body should ensure that assurance services enable an effective internal controls environment, and that these support the integrity of information for internal decision making and of the organisation’s external reports.

The committee is pleased to present its report for the 2022-23 performance year, to the Standing Committee on the Auditor-General (Scoag) and all other stakeholders of the Auditor-General of South Africa (AGSA).

Committee governance

The committee is a statutory oversight structure, constituted in terms of section 40 of the Public Audit Act 25 of 2004. The committee is accountable to the auditor-general and Scoag.

The composition and meetings of the audit committee are outlined in section 3 of this report. In line with the PAA, all members of the committee are independent of the AGSA and have, in accordance with their statutory responsibilities, attended all committee meetings. Furthermore, the members have periodically declared their independence and that they are free of any conflict of interest in discharging their statutory duties throughout the reporting period.

The committee’s terms of reference are developed in line with best practice. They outline its processes and responsibilities, are reviewed annually and are approved by the auditor-general, as necessary. Furthermore, the committee develops an annual work plan that directs its activities.

The committee accordingly conducted its affairs and discharged its responsibilities to enable it to conclude, as outlined in its activities below, that for the reporting period:

- The systems of internal control over financial reporting were adequate and operated effectively

- Risk management processes were adequate and effective

- The organisation has the appropriate resources and financial expertise to perform its duties

Activities of the committee

External audit and evaluation of the annual financial statements

The committee assessed the external auditor’s independence as required by section 39(2)(b) of the PAA and confirms that Crowe JHB (Crowe) is independent and not conflicted in any way. Furthermore, the committee is satisfied that the 2022-23 financial year audit was effectively conducted by Crowe. As such, the committee recommends their re-appointment for the 2023-24 financial year. According to section 39(1) of the PAA, Scoag has the authority to appoint the external auditor and does so, on an annual basis.

As required by its terms of reference, the committee:

- considered the audit approach and audit risks in approving the external audit plan

- reviewed the annual financial statements and agreed with management that the AGSA is a going concern

- considered the appropriateness of the accounting policies, accounting treatments, any significant unusual transactions and judgement areas

- reviewed compliance with International Financial Reporting Standards (IFRS) and the PAA

- considered and reviewed the management reports and the summary of unadjusted differences

- reviewed the audit report on the annual financial statements and the performance against predetermined objectives

- ongoing monitoring of non-audit services to ensure they are not significant in relation to the audit fees, to ensure the external auditor’s independence is not compromised

- engaged with the external auditors in the absence of management, to ensure that the quality, credibility and effectiveness of the external audit process was maintained

- received confirmation that no pressure was exerted on the auditor to suppress any findings nor were there any scope limitations placed on their work

- considered all factors and risks that may impact on the integrity of information in the integrated annual report (“IAR”) and that it presents the economic, social and environmental performance of the AGSA

Following the review of the management representation letters addressed to Crowe, and commentary to the annual financial statements and the IAR, the audit committee recommended that the AG sign off on the IAR and its individual components.

Internal audit

SNG-Grant Thornton (SNG-GT) are the internal auditors of the AGSA. The 2022-23 financial year was their first year of audit. The internal audit plan operates on a three-year rolling basis; all key finance functions of the organisation are covered at least once during the three-year cycle.

In accordance with its terms of reference and the internal audit charter, the committee:

Internal Audit:

- reviewed and approved the annual internal audit plan and the internal audit charter

- considered reports from SNG-GT on the internal audit work performed throughout the year, and their annual written assessment, which concluded that the internal controls in the areas tested, are adequate and effective

- met separately with the internal auditor without management present to ensure that the independence, quality, credibility, and effectiveness of the internal audit process was maintained at all times; and received confirmation that no restrictions nor pressure was put on them to suppress audit findings.

The committee is assured that, considering the work done in the current year by the internal auditors, the systems of internal control in place at the AGSA are adequate and operating effectively, a notable improvement in the control environment has also been observed. The IT security controls were found to be partially effective. This is due to the identification of new vulnerabilities emerging from an environment review conducted during the year. These ongoing IT security reviews, together with a heightened awareness of the cybersecurity threat and more robust risk identification facilitate much needed focus in this area. It should be noted that the risk posed by the weaknesses in the IT security environment is receiving further attention through the ongoing closure of audit findings and initiatives in the new enterprise architecture work.

Risk management

Under the stewardship of a chief risk officer, the Risk and Ethics business unit (R&E) is responsible for coordinating the risk management function in the AGSA. The chief risk officer concludes that the systems of internal controls, risk management process as well as compliance with laws and regulations employed throughout the financial year by the organisation are adequate and effective to manage risks to an acceptable level.

The committee exercised oversight on:

- the identification of strategic risks of the organisation, where it monitored implementation of the mitigations agreed with management to manage the risks to an acceptable level

- review and approval of the strategic risk profile and risk appetite statement for the 2022-23 financial period, and monitored the organisation’s performance in relation to the appetite measures defined

- received assurance in line with the 2022-23 combined assurance matrix ensuring that assurance is obtained for all material risk areas, and that assurance by the different assurance providers is adequate

- the assurance received from the internal auditors on the risk management function, financial and internal control environment, including fraud risk and compliance management systems

Furthermore, the committee approved the combined assurance matrix for application in the 2023-24 performance period.

Given the quality of the risk management and oversight processes in place, we confirm there is a robust risk management system in place. We believe that key material risks have been identified with clear management actions and are confident that the risk management system is functioning adequately and continues to mature.

Assessment of the finance function and the chief financial officer

The committee considered the composition, experience and skills set of the finance function as well as the performance and expertise of the chief financial officer and is satisfied that the function has the requisite capacity and appropriate skills to fulfil their responsibilities.

Key focus area

During the 2022-23 performance period, the committee’s focus was on supporting the executive committee in implementing the #cultureshift2030 strategy and improving their information technology function.

Another focus of the committee during the year under review was to review the recommendations emanating from various reports following the event involving the former chief people officer’s allegations against the auditor-general, and ensure that they are appropriately addressed. The committee rendered guidance and support in this regard and is satisfied with the deputy auditor- general’s progress to date. The committee remains available to provide the necessary support until all items have been remediated.

Conclusion

The committee concludes that the systems of internal control over financial reporting, as well as the risk management processes for the AGSA, are adequate and operating effectively. Key focus areas outlined above remain our guide in terms of optimising the environment of internal controls.

The committee recommended that the deputy auditor-general may sign the annual financial statements and that the deputy auditor-general and the auditor-general may sign the integrated annual report 2022-23.

Finally, the committee is satisfied that it has adequately discharged its responsibilities as outlined in various statutory and other governance documents during the current financial year.

REMUNERATION COMMITTEE REPORT

Background

The auditor-general is responsible for determining the terms and conditions of employment of all employees in the organisation, in accordance with section 34(3) of the PAA.

The remuneration committee (remco) was established as an oversight governance structure to provide specialised advice to the auditor-general on remuneration and related issues, while the final decision-making rests with the auditor-general. One of its primary purposes is to ensure that the organisation’s remuneration principles, policies and practices are fair and transparent so as to promote the achievement of strategic objectives.

Remuneration committee membership

To ensure adherence to good governance practices, the members of the remuneration committee are appointed for a period of three years subject to an annual review. No changes in membership have occurred in the 2022-23 financial year.

Members of the governance structures are remunerated in line with the approved South African Institute of Chartered Accountants (Saica) rates. This currently stands at R3 201 per hour.

An overview of the main provisions of the remuneration policy

The organisation has developed a remuneration policy, procedures and processes that are made available to all employees. Any amendments to the policy principles are communicated to employees following consultations (where applicable).

The AGSA’s approach to recognising and rewarding employees is based on a total reward philosophy in which the benefits of working for the AGSA are considered in their entirety.

These include financial and non-financial benefits, rewards and the working environment. The total reward policy has been designed to support the achievement of the organisation’s objectives, reinforce organisational values and behaviours, and recognise outstanding contributions made by individuals and teams. The policy principles are implemented in accordance with the provisions of the organisation’s management approval framework.

The AGSA has indicated that it will review its remuneration philosophy, strategy, policies, procedures and practices that will underpin the organisation’s strategic aspirations as set out in the #cultureshift2030 strategy and will consult the committee in due time.

Remuneration of AGSA executives

The AGSA remunerates its executives in terms of the AGSA remuneration policy. The details of executives’ remuneration are reported as part of the financial statements.

Internal and external factors that influence remuneration

Remuneration considerations and decisions are based on a combination of external and internal factors:

- Sustainability of the organisation – budget considerations and financial affordability

- Market relativity and industry market positioning

- Attraction, retention and employee engagement considerations

- Strengthening performance culture

- Consumer price index (CPI) / inflation

- Economic outlook

Key areas of focus by the remuneration committee

Annual salary increase

On 1 March 2023, remco discussed the annual salary increase process for the 2023-24 financial year. The committee considered multiple aspects including financial affordability, existing policy principles for salary increases, market indicators and internal salary trends. Remco recommended a 5% salary increment for all employees, effective 1 April 2023, based on its considerations of the Cola adjustment policy.

An assessment of the cash flow affordability indicated that the AGSA could afford the salary increases and still be liquid, viable and sustainable going forward. The 5% salary increase would also ensure that the AGSA remains competitive in the market for talent attraction and retention.

Performance bonus consideration

The performance bonus scheme is used to recognise and reward the performance of employees who contribute towards the achievements of the organisation’s goals. This is a short-term incentive, awarded in recognition of an individual’s successful accomplishment of the goals set for the performance year. The payment of the performance bonus is at the discretion of the auditor-general.

Consistent with its mandate, the committee considered and debated the performance bonus proposal at its meeting on 27 July 2023. The committee resolved to recommend the exco proposal that no performance bonus be paid for the 2022-23 financial year.

Use of remuneration consultants

While the organisation strives to use its internal resources to deliver on remuneration initiatives, it should be noted that there have been areas of speciality where external remuneration reports were used due to the nature of benchmarking required.

Post-retirement medical aid (PRMA) liability

The PRMA is a historical employee benefit governed by the Audit Arrangements Act and Policy Framework on Medical Assistance. The AGSA has aimed to eliminate the financial liability associated with the postretirement medical aid subsidy benefit by offering to pay a settlement to all its beneficiaries.

All 372 (146 in-service, 226 external) beneficiaries were included in the offer. Of these, 35 external beneficiaries could not be traced. Of the 337 (146 in-service, 191 external) beneficiaries that were successfully contacted:

- (80,12%) 270 beneficiaries (137 in-service, 133 external) accepted the offer

- (12,46%) 42 beneficiaries (5 in-service, 37 external) rejected the offer,

- (7,42%) 25 beneficiaries (4 in-service, 21 external), did not respond in time

Overall, this endeavor has been a great success thanks to the number of members who accepted the offer.

The committee remains dedicated to providing guidance and advice on total reward and recognition strategies, principles and decisions, to align employee motivation with the organisation’s strategy. The committee appreciated that staff remained committed to achieving the goals of the organisation.

INDEPENDENT ASSURANCE PRACTITIONER’S LIMITED ASSURANCE REPORT TO PARLIAMENT ON SELECTED KEY SUSTAINABILITY INDICATORS

Report on selected key sustainability indicators

We have undertaken a limited assurance engagement on selected key sustainability indicators, as described below, and presented in the 2022-23 Integrated annual report of the Auditor-General of South Africa (AGSA) for the year ended 31 March 2023 (the report).

Subject matter

We have been engaged to provide a limited assurance conclusion in our report on the following selected key sustainability indicators, prepared in accordance with the Global Reporting Initiative (GRI) G4 Standards.

| Category | Key sustainability indicators | Scope of coverge |

|---|---|---|

| Economic |

Application of the funding model. Amounts and initiatives in respect of:

|

Republic of South Africa |

| Social |

Amounts and initiatives in respect of:

|

Republic of South Africa |

| Cultural |

Disclosures in respect of:

|

Auditor-General of South Africa |

| Stakeholder engagements |

Disclosures in respect of:

|

Republic of South Africa |

Deputy auditor-general’s responsibilities

The deputy auditor-general (DAG) is responsible for the selection, preparation and presentation of the selected key sustainability indicators in accordance with the GRI G4 Standards. This responsibility includes the identification of stakeholders and stakeholder requirements, material issues, commitments with respect to sustainability performance and design, implementation and maintenance of internal control relevant to the preparation of the report that is free from material misstatement, whether due to fraud or error.

The DAG is also responsible for determining the appropriateness of the measurement and reporting criteria in view of the intended users of the selected key sustainability indicators and for ensuring that those criteria are publicly available to the report users.

Our independence and quality control

We have complied with the independence and all other ethical requirements of the Code of Professional Conduct for Registered Auditors, issued by the Independent Regulatory Board for Auditors (IRBA), that is consistent with the International Ethics Standards Board for Accountants’ International Code of ethics for professional accountants, which is founded on fundamental principles of integrity, objectivity, professional competence and due care, confidentiality and professional behaviour.

Crowe JHB applies the International Standard on Quality Management 1, and accordingly maintains a comprehensive system of quality control including documented policies and procedures regarding compliance with ethical requirements, professional standards and applicable legal and regulatory requirements.

Auditor’s responsibility

Our responsibility is to express a limited assurance conclusion on the selected key sustainability indicators based on the procedures we have performed and the evidence we have obtained. We conducted our limited assurance engagement in accordance with the International Standard on Assurance Engagements (ISAE) 3000 (Revised), Assurance Engagements other than Audits or Reviews of Historical Financial Information, issued by the International Auditing and Assurance Standards Board. That Standard requires that we plan and perform our engagement to obtain limited assurance about whether the selected key sustainability indicators are free from material misstatement.

A limited assurance engagement undertaken in accordance with ISAE 3000 (Revised) involves assessing the suitability in the circumstances of AGSA’s use of GRI G4 Standards as the basis of preparation for the selected key sustainability indicators, assessing the risks of material misstatement of the selected key sustainability indicators whether due to fraud or error, responding to the assessed risks as necessary in the circumstances, and evaluating the overall presentation of the selected key sustainability indicators.

A limited assurance engagement is substantially less in scope than a reasonable assurance engagement in relation to both risk assessment procedures, including an understanding of internal control, and the procedures performed in response to the assessed risks.

The procedures we performed were based on our professional judgement and included inquiries, observation of processes followed, inspection of documents, analytical procedures, evaluating the appropriateness of quantification methods and reporting policies, and agreeing or reconciling with underlying records.

Given the circumstances of the engagement, in performing the procedures listed above we:

Interviewed management and senior executives to obtain an understanding of the internal control environment, risk assessment process and information systems relevant to the sustainability reporting process;

Inspected documentation to corroborate the statements of management and senior executives in our interviews;

Tested the processes and systems to generate, collate, aggregate, monitor and report the selected key sustainability indicators;

Performed a controls walkthrough of identified key controls;

Inspected supporting documentation on a sample basis and performed analytical procedures to evaluate the data generation and reporting processes against the reporting criteria;

Evaluated the reasonableness and appropriateness of significant estimates and judgements made by the DAG in the preparation of the selected key sustainability indicators; and

Evaluated whether the selected key sustainability indicators presented in the report are consistent with our overall knowledge and experience of sustainability management and performance at AGSA.

The procedures performed in a limited assurance engagement vary in nature and timing, and are less in extent than for a reasonable assurance engagement. As a result, the level of assurance obtained in a limited assurance engagement is substantially lower than the assurance that would have been obtained had we performed a reasonable assurance engagement.

Accordingly, we do not express a reasonable assurance opinion about whether AGSA’s selected key sustainability indicators have been prepared, in all material respects, in accordance with GRI G4 Standards.

Limited assurance conclusion

Based on the procedures we have performed and the evidence we have obtained, nothing has come to our attention that causes us to believe that the selected key sustainability indicators as set out in the subject matter paragraph above for the year ended 31 March 2023 are not prepared, in all material respects, in accordance with GRI G4 Standards.

Other matters

The maintenance and integrity of the AGSA’s website is the responsibility of AGSA management. Our procedures did not involve consideration of these matters and, accordingly, we accept no responsibility for any changes to either the information in the report or our independent limited assurance report that may have occurred since the initial date of its presentation on AGSA’s website.

Restriction of liability

Our work has been undertaken to enable us to express a limited assurance conclusion on the selected key sustainability information to the AGSA in accordance with the terms of our engagement, and for no other purpose. We do not accept or assume liability to any party other than AGSA, for our work, for this report, or for the conclusion we have reached.