Our mandate and legal form

The AGSA is South Africa’s supreme audit institution, with a mandate stemming from chapter 9 of the Constitution of the Republic of South Africa, 1996. This makes us one of six state institutions that support constitutional democracy. The Constitution entrenches the AGSA’s independence, subject only to the Constitution and the law. In turn, the Constitution requires us to be impartial, and to exercise our powers and perform our functions without fear, favour or prejudice.

The AGSA is an organ of state as defined by sub-section 239(b)(i) of the Constitution, has full legal capacity and acts as a juristic person.

Accountability and reporting

We account to the National Assembly by tabling our annual report, financial statements and the audit report on those financial statements. This requirement is governed by sub-section 10(2)(b) of the PAA.

Our functions, beneficiaries and products

Section 188 of the Constitution describes our functions and chapters 2 and 3 of the PAA regulate the powers necessary to perform them. By law, we audit and report on how the government spends the South African taxpayers’ money.

Definitions

According to section 1(1) of the PAA, a material irregularity (MI) occurs when:

- a person does not comply with or contravenes legislation, engages in fraud or theft, or violates their entrusted duty

- this action can or does result in a significant financial loss, the misuse or loss of a significant public resource or substantial harm to a public sector institution or the general public

- the action is identified during an audit performed under the PAA

Every year, we audit national and provincial government departments, certain public entities, municipalities and municipal entities (our auditees). We issue audit reports that provide them with the outcomes of our audits and emphasise material irregularities where we find them.

When audit outcomes include material irregularities, we can either refer them to public bodies for investigation or include recommendations to address them in the audit report. In the case of the latter, if our recommendations are not implemented, we take binding remedial action. Where the accounting officer or authority does not implement the remedial action, the auditor-general can issue a certificate of debt to recover money lost from accounting officers or authorities.

Definitions

Binding remedial action directs the accounting officer or authority to address cases where our recommendations are not implemented. In the case of a financial loss, the accounting officer must calculate the loss and recover it from the person responsible.

A certificate of debt is a certificate issued in terms of section 5B(1) of the PAA when remedial action has not been taken. It requires the accounting officer or authority to repay the specified financial loss to the state.

Definitions

Regularity audit is our mandated examination and reporting on an auditee’s financial statements. It also examines the auditee’s compliance with relevant legislation and its reporting on its performance against its own predetermined objectives.

Specialised audit services is a division of the AGSA that nurtures and provides specialised skills and techniques for in-depth audits based on the auditee risk profile. These audits can be standalone or integrated with regularity audits and other discretionary audits. The three specialised audit services business units are investigations, information system audit and performance audit.

We undertake two main types of audits: regularity audits and discretionary audits such as performance audits, special audits and investigations.

All our reports are meant to help the legislature call the executive to account for the way they manage public funds. Auditees include our regularity audit reports in their respective annual reports, which they table in their relevant legislature (National Assembly, provincial legislatures or municipal councils). The reports may also be made available to bodies with a direct interest in the particular audit and to any other legislature or organ of state if we consider it in the public interest to do so.

In addition to these audit reports, we publish general reports in which we analyse the outcomes of the regularity audits at national, provincial and municipal levels, and special reports that analyse our findings from real-time or other standalone discretionary audits.

External charters and value added statement

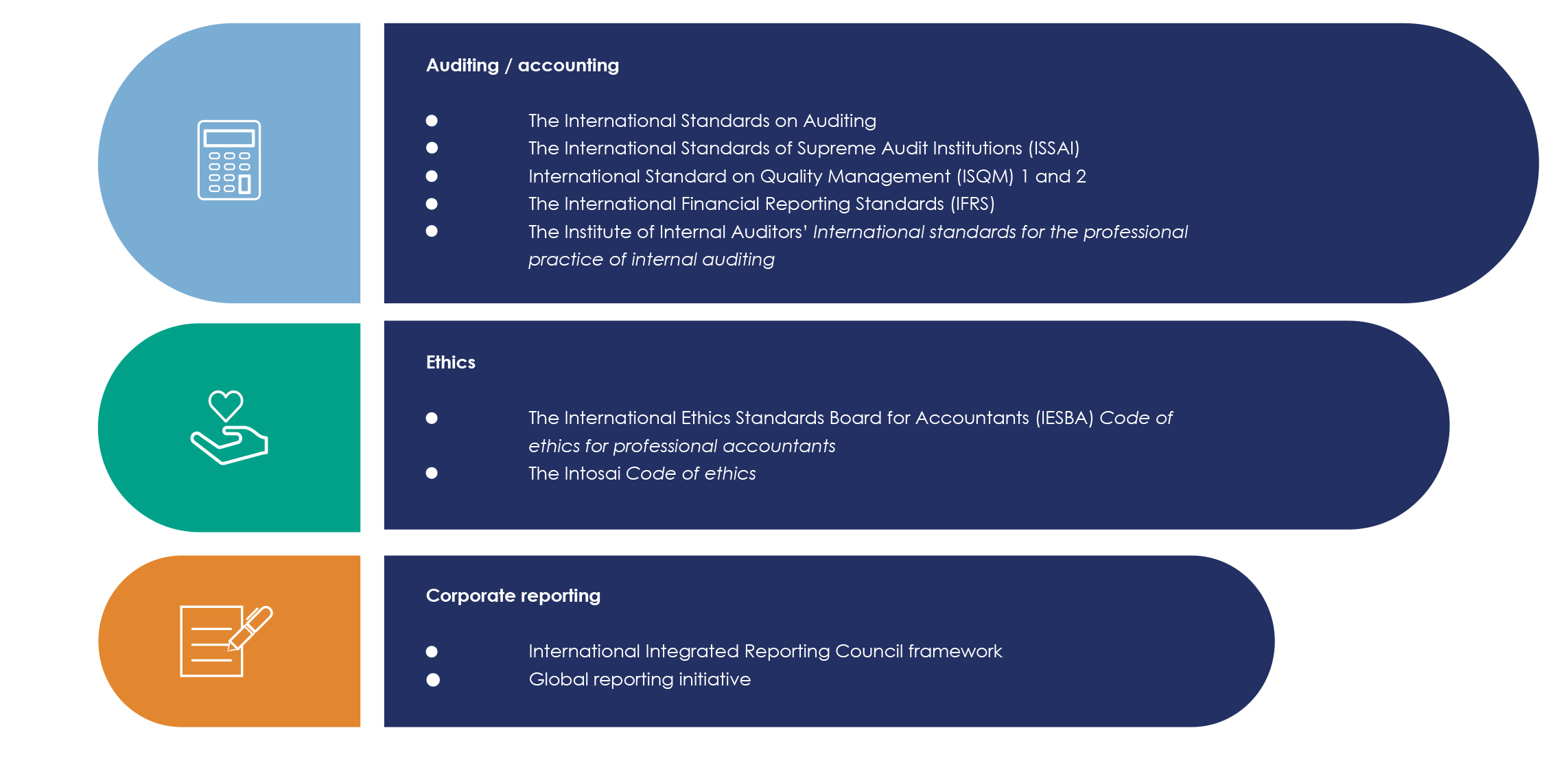

External charters, principles and initiatives that we subscribe to or endorse

The AGSA is an active member of the International Organisation of Supreme Audit Institutions (Intosai). We lead the capacity building committee (CBC), which is Intosai’s advocate and custodian for supreme audit institutions’ capacity development. The AGSA participate in several of Intosai’s working groups aimed at exchanging ideas, knowledge and experience.

between its members as well as working on finding common solutions to identified challenges. We host the secretariat of the African Organisation of English-speaking Supreme Audit Institutions (Afrosai-e), a regional chapter of Intosai.

We subscribe to the following standards and principles:

2022-23 Value-added statement

Organisation’s supply chain

In line with the principles prescribed in the Constitution, we maintain a procurement and provisioning system that is fair, equitable, transparent, competitive and cost-effective.

Audit contracts awarded

As part of our business model, we outsource some of our audit work. The firms that audit on our behalf are appointed using a transparent selection process that considers their size, location, expertise and quality of audit work.

The appointment process also incorporates the principles of transformation to develop, grow and advance black chartered accountants. Outsourced work included pre-issuance reviews, regularity audits, information systems audits and performance audits.

2022-23 spend on core audit work by private firms:

Non-audit supplier database

Our vendor and service providers vetting system features enhance probity checks on all prospective service providers, vendors and their directors. In our quest to lead by example, we apply key principles emanating from the work of the Commission of inquiry into state capture, being pedantic in detecting possible conflicts of interest.

During the reporting period, we conducted a thorough review of all service providers and vendors registered on our system. We improved the status of our database by deactivating 1 832 dormant suppliers, which resulted in a lean, easily managable supplier database.

We safeguard against paying a high premium for goods and services received. Our legal team negotiates all contracts with a value above R1 million.

Our digital transformation strategy is based on the phasing in of new audit tools and technologies that will allow us to audit more efficiently and generate unique audit insight for the benefit of our stakeholders.

Major procurement processes include our audit software replacement, DataSnipper tool, enterprise-wide project management office system, financial strategy and funding model development and the managed security services for the AGSA’s IT environment.

Conditions under which we operate

Insufficient improvement to audit outcomes

The limited progress in improving audit outcomes, especially at auditees that are critical for driving service delivery, results in a pronounced, negative impact on the people of South Africa. These trends are most evident at local government level and in state-owned enterprises – something that is of significant concern to the AGSA, Parliament and citizens.

Audit outcomes relate directly to the work we do, and lack of improvement has an indirect effect on how the public and government perceive our relevance and effectiveness. The reflection on how to enhance our relevance and effectiveness has formed the basis of our #cultureshift2030 strategy, which targets improvement of public sector culture.

Persistent fraud and corruption

In our daily work we are faced with the continuous misuse of state resources. The freedom of speech in our country has allowed the media to highlight numerous cases of fraud and corruption.

Many civil society organisations take up the fight against the spillage of public resources within the scope of their work. The AGSA is determined to provide insight and transparency on indicators of fraud, corruption and state capture that we detect through our audits.

This will allow our stakeholders to continue holding government accountable, which in the long term should lead to improved state performance and betterment of lives of people.

Decline in the country’s economic outlook and its financial impact on us

South Africa’s economic outlook has declined, mainly as a result of the pandemic. This has seen a stagnation in our low global economic ratings and presents government with fiscal constraints to delivering its programmes and generating revenue, especially at local government level, which exerts continued pressure on audit fees.

The war in Ukraine carried significant risks to the global, and by implication, the South African economy that had not recovered from the covid-19 pandemic. It has directly led to higher oil and grain prices, which has had adverse implications for price inflation in the country. The high inflation erodes the disposable income of consumers who already struggle to feed their families and meet commitments to financial institutions. This will make it harder for municipalities to collect customer debt for services rendered.

Collecting outstanding debt, predominantly from local government and ailing state-owned enterprises, remains a challenge. We expect this trend to increase given the loss of revenue throughout the pandemic and the Russia-Ukraine war.

Furthermore, we expect to see deterioration of service delivery at local government level specifically because of the lack of sufficient financial resources.

Complex audit environment

Our state-owned enterprises audit portfolio has grown over the years, increasing the number of specialised and complex environments that we audit. Although the pace of this change has exerted pressure on our resources, it has led to intensive training and learning for our staff.

Currently, we continue to invest in understanding the audit environment and scope of Eskom with the intention of signing off the Eskom audit within the next three years, once we have had a chance to create the necessary capacity and capability for such a complex audit.

Conducting real-time audits has increased our need for specialised audit skills, especially investigations skills. We have experienced some challenges in recruiting these skills and capacity due to the limited availability of specialised skills in the market. We continue to mitigate this challenge through internal initiatives such as training, internships, promoting suitably skilled officials and employing outsourced resources on fixed-term contracts.

Implementing the material irregularity process intensified our need for greater skills and capacity to perform high-quality audits. While our initial focus was to master the implementation of our extended power, now our attention is towards the identification of impactful material irregularities, i.e. those that once resolved will result in improving the lives of South African people.

The poor quality of the annual financial and performance reports submitted by many of our auditees has a negative impact on the timeframe and quality of our audits because additional work is needed to respond to the risks posed by misstatements. Persistently we see internal control environments that are inadequately managed. Weak preventative controls and the disregard for our audit messages increase the audit risk profile.

Audit contestations have become a feature of our environment and we will continue to track such cases to understand how we can engage with the respective stakeholders to pre-empt pushbacks. A possible increase in contestations resulting from our enhanced mandate could pose a threat to our staff and an increase in judicial scrutiny of our reports. We use various internal platforms to support our staff to maintain their ethical conduct and make the right choices.

Increased risk of cyberattacks and new technologies

With cyberattacks on the rise globally, we recognise the potential for data breaches and have taken steps to protect our information from such threats. Phishing attempts continued though they were identified early and contained by our information and communication technology specialists. We will continue to intensify our information management and security measures to secure the information collected during our audits.